ESI Registration | Apply Online For ESI With Us

-:- Welcome To The LeadingFile Services -:-

Outsource Your ESI Registration To Us; & Let Our Online ESIC Registrar Apply For You!

We – India’s largest registrar of companies & secretarial compliances. The reason beyond being so and so is “WOW – The Only Feedback Our Registrar Aim For” and our services which we cover.

Needless to say, scale your business with a partnership that works: “LeadingFile!”

We at LeadingFile; covers almost all the aspects, likely to be contained – ESIC registration, EPF/PF registration, GST registration, Private limited company registration, Indian subsidiary registration, TAN registration, Nidhi company registration, and much more registrations, tax filings, etc.

Scrolling back to the stuff i.e ESI Registration. Let’s get cracked to the same!

Definition — “[ESI] stands for the ‘Employee’s State Insurance’ and is a self-financing standardized social security as well as health care coverage insurance scheme,” In order to which the employer/employee makes a registration i.e, ESI registration.”

Fast forward, In accordance with ESI act, 1948; the ESI scheme is managed by ESIC (Employees’ State Insurance Corporation), which itself is an autonomous body created by the law of India’s government, underneath the ministry of labour and employment.

So, those who are eligible and wish to get registered under ESI visit LeadingFile! Contiguously, making your ESI Register with us can assist you with all your queries related to the ESIC || ESI registration.

[ESI Register; It in complete stands for ’employee’s state insurance register’, and somehow means – make yourself register with ESI.]

All right, in order to do so & so crawl till the last heading, illustrating the complete ESI registration process. Not only the registration, we too will allot you the full assistance in respect of the below-shown commodities –

Establish ESI Number

For you – we will establish a 17 digit Employee’s State Insurance (ESI) number.

ESIC Registration

We at LeadingFile apply for both employer/employee ESIC registration.

Check ESI Status

We will do a thorough check of your Employee’s State Insurance (ESI) status.

At last, if you are glancing for a game changer, then, your employee’s state insurance (ESI) registration native is just a click away – LeadingFile!

All You Need To Know About - ESIC & ESI Registration

Liberating Your Employee’s Dream? Register An — ESI With Us!

Being India’s no #1 business service platform provider, we allot you the full assistance in respect of the ESIC & itself the ESI registration.

Likely to be contained – ESIC registration >> ESIC login >> ESIC payment >> ESIC number search by name… Next, in the faith of ESI registration, we allot – ESI registration form >> ESI login >> ESI number >> ESI filing…

But before these all, one might be glancing for: what is ESIC/ESI? Letting you – the depth overview of the same…

[ESIC/ESI] both are abbreviated as – “Employee’s State Insurance Corporation” and “Employee’s State Insurance”, respectively.

Fast forward, in accordance with the rules & regulations prescribed in the ESI act, 1948; ESI (Employee’s State Insurance) is a self-financing social security & health insurance fund scheme, for all the Indian employers/e’s.

Whereon – it is no secret that the ESI scheme is started for Indian workers and is completely managed by the ESIC (Employee’s State Insurance Corporation). Henceforth, the ESIC through his large network of ESI branch offices, ESI dispensaries and ESI hospitals, aligns the employee and their family with a huge variety of monetary, sickness, vocational, dependent, medical, maternity, disablement, education and much more benefits from the employer.

But, what the eligibility for ESI or who is eligible for ESI?

Literally, for grabbing the ESI, it is mandatory for the organizations, employing 10 & somewhere 20 or more employees ( State Wise -[popup_anything id=”3039″]) to have the ESI registration. Often, it too is mandatory for the employees earning less than Rs. 15,000 per month to get registered under ESI through ESIC.

In other words – any of the organization holding more than 10 & somewhere 20 employees who have a maximum salary of Rs. 15,000 has to mandatorily register itself under ESI registration with the ESIC (Employee’s State Insurance Corporation), within 15 days of the ESI act, 1948 applicability.

Now, you might be looking for – what these ESI funds is made of?

Meanwhile, you’re looking beyond the ESI process! The very process says – benefits provided by the scheme are funded from the contributions raised by the employees and their employers, at the fixed percentage of wages.

There out the contribution percentage raised by the employer is 4.75% (3% in newly implemented areas for the initial 2 years) of the total monthly salary payable to the employees.

Whereas, the contribution percentage raised by the employee is 1.75% (1% in newly implemented areas for the initial 2 years) of his monthly salary, every month of the year. Next, the contribution raised by the state government is 1/8th of the total medical benefits.

However, there is no exemption to the employees in paying his/her contribution, instead of the employee whose salary is less than Rs 100/day.

Finally, let’s reach out to the entities which undercome the ESIC. In accordance with the government notification dated Sec 1(5) of the ESI act, following illustrated are the entities that are covered under the ESIC.

So, those who are eligible and wish to get registered under ESI visit LeadingFile!

Last but not least, our team of professional experts, company secretaries and CA (Chartered Accountants) are always there for you like 24/7.

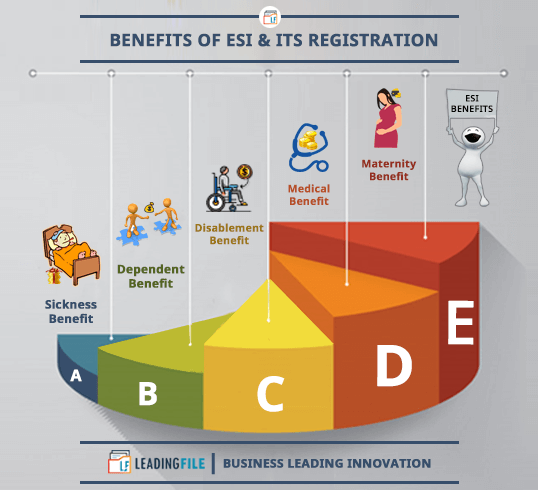

Benefits Of ESI & Its Registration

As off – ESI registration is one of the most reliable, beneficial & mandatory scheme, run by the government of India!

Being so and so, it covers all the risk factors of the wage earners, drawing less than or equal to Rs 15,000 per month and of the employees working in an organized sector.

To which ESI registration predicts the following social security benefits or advantages; elaborated as follows :-

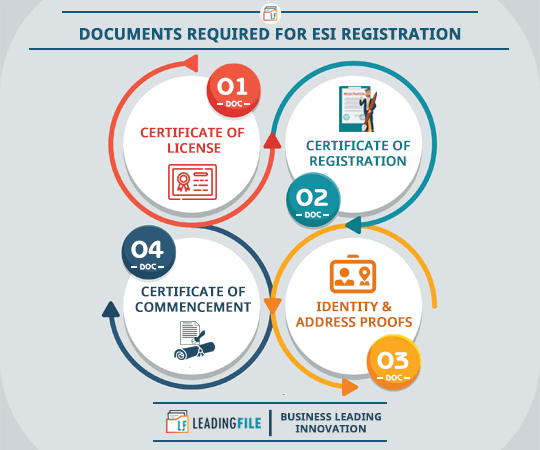

Documents Required For ESI Registration

Following are the documents required/demanded from ESIC for ESI Registration in India: elaborated as follows :-

Key Highlights Of ESI Registration

From the knowledge of ESIC — employee’s state insurance (ESI) is a self-financing social security and health insurance scheme, allotted for the Indian workers. The very scheme protects them during the sickness, injury or any other disability.

Further on, to make it a bit easier for you to understand the things, we encapsulated and elaborated the key highlights of the ESI registration.

Let’s discuss them in detail…

ESI Registration Process | LeadingFile

Discover How We Can Help You With Your ESI Registration Procedure?

Expect nothing less than perfect from LeadingFile!

As off – the registration of employers/employees under ESI act is fully online. Whereon, there is no need for any manual intervention or approval. So, join a community overflowing with the online business opportunities & secretarial compliances.

LeadingFile.com; can assist you in obtaining ESI registration, online within 12 – 20 working days, subject to the govt and client processing time.