Apply Online For “GST Registration” With Us

One Step Towards Transparency. Since – Your GST Registration Native Is One Step Away!

The only line to utter is – Get your business registered under GST (Permanent || [simple_tooltip content=’A registration, which is done on the casual basis, ends within a short-term period and often called GST casual registration – is known to be a temporary GST registration. Read more >>’]Temporary GST Registration[/simple_tooltip]), online for free along with the best registrar i.e, LeadingFile, and stay ahead on GST compliance.

LeadingFile: a ignite visible and India’s largest business services platform provider. An alter proof towards the very statement is – our portfolios & [simple_tooltip content=’

‘]registration portal list[/simple_tooltip], to name a few: GST, Proprietorship, Partnership, One Person Company, Limited Liability Partnership, Private Limited Company, and many more registrations.

Thus, it’s a great time for the [simple_tooltip content=’Individuals those who do entrepreneurship are known to be entrepreneurs. Wherein, entrepreneurship is a process of creating || designing || launching || running a new or startup business.

Kinda off the topic but if you literally wish to start a business, visit @LeadingFile…!!!

‘]entrepreneurs[/simple_tooltip] to take their firms at the next level with our – “GST registration service.”

Admirably, It is translucent clear that the appeal of GST registration in India has increased in overall businesses. And is one of the biggest tax reforms in India, now-a-days.

Now, you must be glancing for some of its wisdom details of GST like: [simple_tooltip content=’A goods and services tax registration which subsumes various indirect taxes (state taxes and central taxes) in it — is known to be a GST registration.’]what is GST registration[/simple_tooltip], where it is applied and how the brand new GST registration is made? So, let’s get flawed to the respective questionnaires –

(GST) – which commonly stands for ‘Goods & Services Tax’, is an [simple_tooltip content=’A tax reform which is collected by the retailers from the consumers. For instance — Sales Tax || VAT (Value Added Tax) || Per-Unit Tax || GST (Goods and Services Tax) || Tariff Tax || Excise Tax.’]indirect[/simple_tooltip] or [simple_tooltip content=’A tax reform which is usually indirect as well as direct, and is applied on the consumption spending.’]consumption tax[/simple_tooltip] which is applied to the supply of goods and services in India.

Analog | Definition – “A registration, which subsumes various indirect taxes in it, likely to be elaborated as:

State Taxes – which includes:

Octroi Tax, Luxury Tax, Entertainment Tax and VAT (Value Added Tax)

Central Taxes – which includes:

Sales Tax, Services Tax, Excise Duty Tax and CDT (Customs Duty Tax)

– is known to be a GST registration.”

Meanwhile, this registration was made to regulate prices throughout the country. And often, to remove all the state or central government imposed [simple_tooltip content=’A tax reform which is collected by the retailers from the consumers. For instance — sales tax || VAT (Value Added Tax) || per-unit tax || GST (Goods and Services Tax) || tariff tax || excise tax.’]indirect taxes[/simple_tooltip] over the goods and services.

Moving over to the next wisdom detail, we concluded – GST is applied at each and every phase of the production process, but, the applied tax meant to be refunded in various phases of production, despite the final phase or so-called stage.

Further on, if you are glancing for a game changer, then, your GST registration native is just a click away, which will make you learn the entire GST registration process in detail and will include the following illustrated commodities in the package.

All You Need To Know About: GST Registration In India

Process | Eligibility | Status | Expert Help

In Accordance With The Rapid Globalization; GST Is Levied At Every Stage In The Production Process!

Hence, join a community overflowing with the GST registration service opportunity — LeadingFile.Com.

Getting back to the topic, i.e, GST Registration!

The long-awaited GST is now in real, introduced by the Govt of India on 1st July 2017. Itself the goods and services are divided into 5 tax slabs for a collection of the tax which are elaborated as: 0%, 5%, 12%,18% and 28%.

As off, we discussed – GST is one of the biggest tax reform in India, above. Tremendously by letting millions of small businesses in India it is revamping ease of doing business and enlarging the taxpayer base format.

However, by eliminating and lowering many taxes into a single system, tax compliance will be reduced, whereas, the tax base significantly will get increased.

Next – In accordance with the new GST regime, each and every entity which is involved in buying and selling of goods and services or both are required to register for GST. Whereas entities lacking the GST registration will not be allowed to gather GST from clients and none can claim for input tax credit of GST paid.

Being contiguous, some of the criteria’s which are kept in mind to get registered under GST are as:

Well, there are numerous other criteria irrespective of annual turnover which might make an organization liable for opting GST registration.

Note (1): In accordance with the GST rules & regulations – an organization which is required to register for GST must file a GST application within 30 working days from the date on which it has become liable for the GST registration.

Note (2): In accordance with the previous GST tax regime – Products like petroleum, alcoholic drinks, electricity, and real estate are not taxed under GST. Instead, they are taxed separately by the respective state governments.

Being contiguous to the topic, rules & regulations of the tax are governed by GST Council. And a registration to the same typically takes 2 -6 working days.

So, those who are eligible and wish to get registered under GST visit LeadingFile! Our team of professional experts, company secretaries and CA (Chartered Accountants) are always there for you like 24/7.

Last but not least – If you got any hassle during the process of GST registration in India, then get a free consultation on the same time by slotting an appointment with the best advisor from the ignite visible platform i.e, LeadingFile.

LeadingFile – can succor you in obtaining GST registration & GST compliances via a proprietary GST accounting software within 5 -10 working days, subject to the Govt processing time.

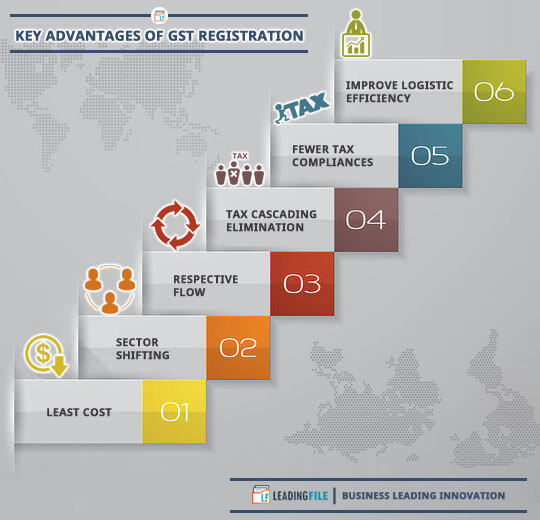

Key Advantages Of GST Registration | LeadingFile

Meanwhile, you glancing for the benefits of registering under GST…!!!

Among the countless, following are the key advantages of getting registered under GST elaborated as follows:

-:- Let’s get flawed to the same -:-

Depth Eligibility Criteria For GST Registration In India

Depth eligibility criteria mean the minimum requirement made for a GST registration. Needless to utter! One holding or being eligible to the illustrated conditions need to get registered under GST.

Fast forward – following are the minimum eligibility for GST registration in India:

-:- Let’s get cracked to the same -:-

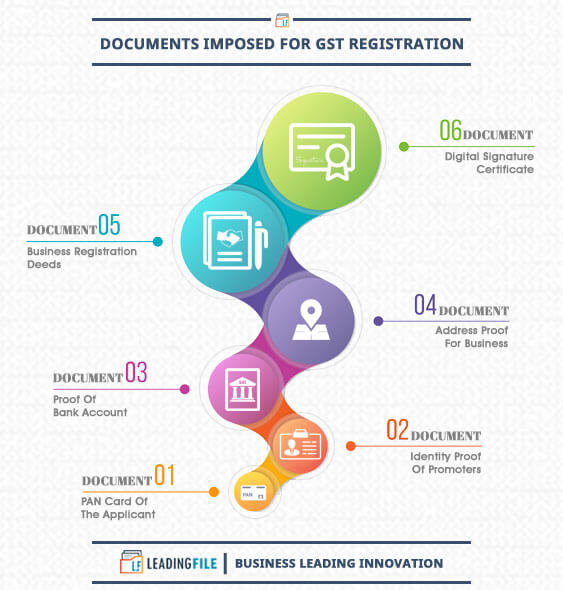

Documents Imposed For GST Registration In India | LeadingFile

-:- Following are the documents required/demanded for GST Registration in India; elaborated as follows -:-

LeadingFile - Gradual Stratagem Towards GST Registration

Gradual stratagem stands for the stepwise procedure made for the GST registration via LeadingFile. Although, this statement states – how LeadingFile succors/helps you in registering a GST.

Being an ignite visible, India’s largest registrar of companies & secretarial compliances assigns the best services among all the entrepreneurs. So, opting us might assist you in registering a GST within 2 to 7 working days, subject to ROC, Govt & Client processing time.

Hence, the only line to utter is – join a community overflowing the opportunities i.e, LeadingFile.

Glimpse Of Our Approach At GST Return Filing

It’s is no secret that GST return filing needs to be done periodically. But the task needs to be performed after obtaining GST registration only. So, join a community overflowing with the opportunities of same!

At the current stage, we will recommend you joining – LeadingFile! As off, it is an ignite visible and India’s largest business services platform provider which also succors with return filing and much more.

Hence, after getting the paperwork done, an organization needs to file the GST returns and those who will fail in doing so – will attract the penalty.

But before this one should know the turnover criteria and submission date. Keep going…

In accordance with GST rules and regulation – the organization with an annual turnover of more than Rs. 1.5 crores which is equal to 15 million INR will have to file monthly GST returns.

Moving forward towards the submission date, normal taxpayers registered under GST need to file three returns on the following illustrated dates, which are as –

Well, GSTR reduces the compliances burden of small businesses. Depth detail towards the twin is as follows:

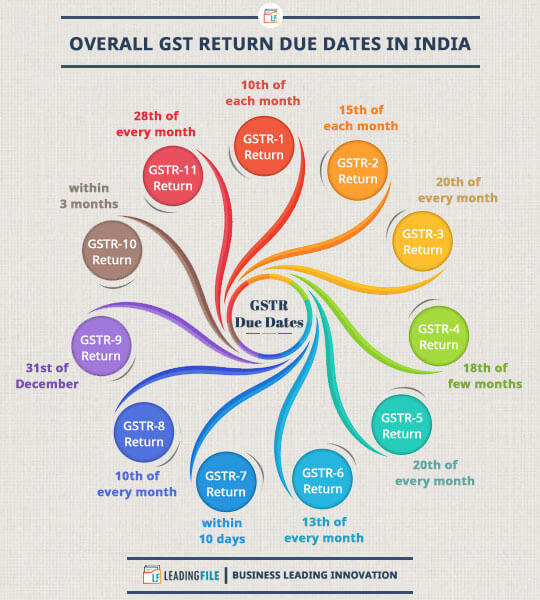

Overall GST Return Due Dates In India

-:- Following are the overall dates to file a GST return in India, illustrated as – along with depth detail -:-

GSTR-1 Return

GSTR-1 completely stands for Goods & Services Tax Return -1st! Well, this return filing is also known as return of outward supplies.

Subsequently, the taxpayers holding regular GST registration must file GSTR-1 and the due date for filing the same is 10th of each month.

Whereas, the due date of July, September and October month are different from the normal schedule.

GSTR-2 Return

Often known as return of inward supplies!

Quite, the due date for filing a GSTR-2 return is 15th of each month.

But, the due date of July, September and October month is quite different from the normal schedule.

GSTR-3 Return

After filing GSTR-1 & GSTR-2 one needs to file for a GSTR-3 return. Well, it is also known as monthly GST return.

And the due date for filing a GSTR-3 or monthly GST return is 20th of every month. However, the exception is made same for every return filing.

GSTR-4 Return

This return leads to the next phase – a taxpayer registered under the GST composition scheme must file GSTR-4.

Being contiguous, the due date for filing a GSTR-4 return is 18th of January, April, July and October month only.

GSTR-6 Return

In accordance with GSTR-6 return filing, a taxpayer registered under GST as an input service distributor needs to file GSTR-6.

However, there is no exception and the due date for filing GSTR-6 is – 13th of every month.

GSTR-8 Return

In accordance to GSTR-8 return filing, the taxpayer collecting tax is needed to file GSTR-8 return.

Likely – a taxpayer operating an e-commerce entity needs to register for TCS (Tax Collected At Source.) Well, the due date for filing the same is – before 10th of every month.

GSTR-10 Return

GSTR-10 is also known as final return and is for those persons whose GST registration has been canceled or surrendered.

Whereas it is required to be filed only by the person whose GST registration has been canceled and due date for filing the GSTR-10 return is – within 3 months of the date of cancellation order.

GSTR-5 Return

Meanwhile, a taxpayer registered under GST as a non-resident taxable person needs to file GSTR-5.

Although, there is no exception and the due date for filing GSTR-5 is 20th of every month.

GSTR-7 Return

After obtaining GST registration, the taxpayer deducting tax is needed to file a TDS (Tax Deducted At Source) return.

Well, there is no certain due date for filing the same, but, it should be made within 10 days from end of the month.

GSTR-9 Return

GSTR-9 needs to be filed by all the regular taxpayers and is GST (Goods & Services Tax) annual return.

However, if a venture holds a turnover of more than Rs. 2 crores, then, detail submitted to the same needs to be audited. Ably, the due date for filing a GSTR-9 return is – before or on 31st of December.

GSTR-11 Return

Last but not least, GSTR-11 return! In accordance with this, a person or taxpayer holding UIN (Unique Identity Number) must file GSTR-11.

However, GST unique identity number is only allotted to few amenities. To that of – consulate and UN bodies, just for claiming the refund on inward supplies. Well, it should be filed by the 28th of every month.