GSTR-1 – Due Date, Format, Eligibility, Rules, and Content of GSTR-1 Form

- January 13, 2020

- Posted by: Editorial Team

- Category:

The GSTR-1, which stands for Goods and Services Tax Return, is a monthly or quarterly return, which basically comprises of information of outward supplies of goods or commodities that are made during a particular month. The various information included in GSTR-1 is debit notes, credit notes, revised invoices and invoices that are related to supplies of tangible goods. The Goods and Services Tax (GST) regulations aim at simplifying and implementing the online filing of tax returns by taxpayers as well as making the entire process efficient.

Who Must File GSTR-1?

Any individual or business that is registered under the Goods and Services Tax (GST) Act, 2017, is required to file their returns by filing the GSTR-1 form and submitting it online. The website/portal where a taxable individual or business is required to file and submit their GSTR-1 is https://gst.gov.in. Even if there are no transactions carried out during a specified month, it is mandated for the person or business assessed to file his/her GSTR-1 return and on a monthly or quarterly basis, as stated in the regulations.

Traders who make a turnover of up to Rs. 1.5 crores in a year are required to file GSTR-1 on a quarterly basis.

Traders who make a turnover of more than Rs. 1.5 crores in a year are required to file GST-1 on a monthly basis.

It is necessary for the taxpayer to digitally sign (electronic signature) after submitting his/her GSTR-1 returns, else the return will not be considered as filed. When the taxpayer successfully submits his/her GSTR-1 return online for the specified period, the system automatically generates an Application Reference Number (ARN) that is provided to the taxpayer. Furthermore, the taxpayer receives both an SMS (direct tax message) and e-mail on the registered phone number and e-mail address that the taxpayer provided during their GST registration. This information is also intimidated via e-mail to the taxpayer’s Authorised Signatory.

It is also important to keep in mind that once the taxpayer files his/her GSTR-1 return, it will not be possible to revise the return filed. So, if the taxpayer has made some mistakes in filling the necessary information, then he/she can rectify the details in the next filing period.

Things to Know Before Filing GSTR-1

Before filing GSTR-1, there are, however, certain pre-requisites that must be fulfilled. These are stated as under:

(a) You must be a registered taxpayer and are required to have a GSTIN (Goods and Services Tax Identification Number) at the time of the tax period, for which the GSTR-1 needs to be fulfilled.

(b) You, as a registered taxpayer, are required to have valid credentials, such as username and password, in order to be used when accessing services on the GST portal/website.

(c) You, as a registered taxpayer, are required to have a valid Digital Signature Certificate (DSC) and that the e-signature is not expired or revoked, as it may be mandatory in some instances.

(d) You, as a registered taxpayer, are required to have the mobile number of the Authorised Signatory, which may be required in case you wish to use the Electronic Verification Code (EVC).

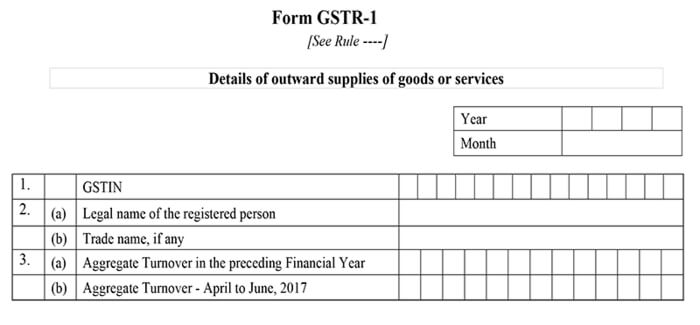

What is the Format of GSTR-1?

Generally, the GSTR-1 contains the following details of a tax period in its form and which are mandated to be met:

- The invoice details of supplies to registered persons, also includes persons who have a Unique Identification Number (UIN) are required to be fulfilled.

- The invoice details of inter-state supplies to unregistered persons or consumers, the value of which is greater than Rs. 2,50,000.

- The details of Debit/Credit notes issued by the supplier toward the invoices.

- The details of the export of goods, which also includes deemed exports in Special Economic Zones (SEZ).

- The summarised state-level details of supplies to unregistered persons or consumers.

- The summarised details of advances received in relation to future supply and their adjustments.

- The details of any amendments with effect to the reported details for any of the categories stated above.

- Those that are rated nil, exempted and supplies that are not specified under GST.

- The detailed summary of outward supplies of goods that are categorized under the Harmonised System of Nomenclature (HSN) and Services Accounting Code (SAC).

Taxpayers are provided with a feature to modify and/or delete invoices at any given number of times until he/she submits their GSTR-1 on the event of that particular tax period. Taxpayers that make an annual turnover of more than Rs. 1.5 crores (but up to Rs. 5 crores) in the previous year are required to include HSN code at two digits level. In case the taxpayer makes an annual turnover of more than Rs. 5 crores in the previous year, then he/she is required to include the four digits of the HSN code.

What is the Due Date for Filing GSTR-1?

It is important to note that when filing your returns, whether it is to be made quarterly, monthly or annually, there is a given deadline, after which a penalty fee is imposed on the taxpayer for any late payments.

Due Date for Quarterly Filing of GSTR-1

- For the period from April to June, the due date is 31st July

- For the period from July to September, the due date is 31st October

- For the period from October to December, the due date is 31st January

- For the period from January to March, the due date is 30th April

Due Date for Monthly Filing of GSTR-1

- For the period from July to September, the due date is 31st October

- For the month of October, the due date is 11th November

- For the month of November, the due date is 11th December

If you have already opted for the quarterly filing of GSTR-1 return, but have not filed any return during the Fiscal Year/Financial Year (FY) as per the defined frequency, in that case, it is possible to change frequency, for which the facility is available online on the GST portal.

What is the Penalty or Late Fee for Not Filing GSTR-1?

If a person or business does not, or fails to file his/her GSTR-1 at the stipulated time, then there is a late fee that is levied on the taxpayer. This penalty can also increase on a per-day basis if the taxpayer delays in filing his/her returns.

As per the penalty amounts set in the GST regulations, a taxpayer will be liable to pay a late fee or fine of Rs. 200 (CGST is Rs. 100 and SGST is Rs. 100, respectively) for not filing his/her GSTR-1 on or before the due date. This late fee amount gets incremented per day.

How to File GSTR-1 Form

There are 13 sections in GSTR 1 form but all sections are not required to be filled and will be auto-filled. The detail of each section are as follow:

Section 1 to Section 3

Outward supplies of goods and services table details.

GSTIN: The GSTIN field in which the government allotted PAN-based 15 digit unique identification number is prefilled.

Taxpayer name

- The legal name of the registered individual

- Trade name(if any)

Turnover of the taxpayer:

- Aggregate turnover in the preceding financial year: The detail of the total supplies of goods and services will have to fill up at the first time of filing. In the future or next time, it will be auto-calculated and auto-populated.

- Aggregate turnover April to June 2017: In this, you will have to fill the detail of sales and supplies that you made of goods and services between the financial year and GST rollout.

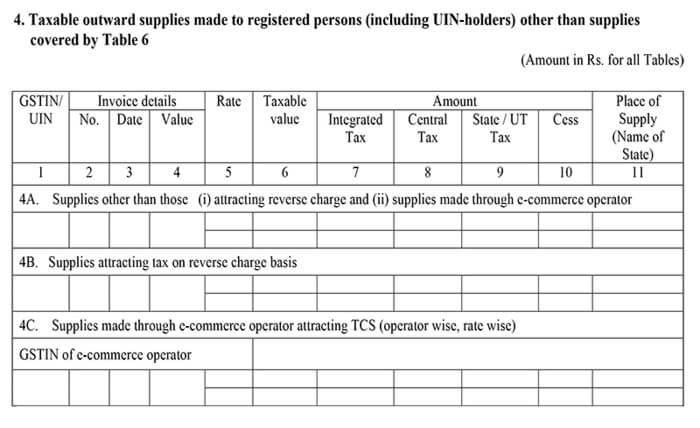

Section 4

Taxable outward supplies made to be a registered person (including UIN holder) excluding the table of 6

Invoice wise detail of taxable supplies done by any company to the registered taxpayers. The detail includes normal taxpayer supplies, supplies under reverse charge mechanism, and supplies made by the e-commerce operators.

4(A): Detail regarding normal taxable sales/supplies except involved in 4(B) and 4(C)

4(B): In this table, the supplies made under the reverse charge mechanism rate wise should be mentioned.

4(C): Under this table, you have to fill supplies made through e-commerce operators attracting the collection of tax at source operator-wise, rate-wise.

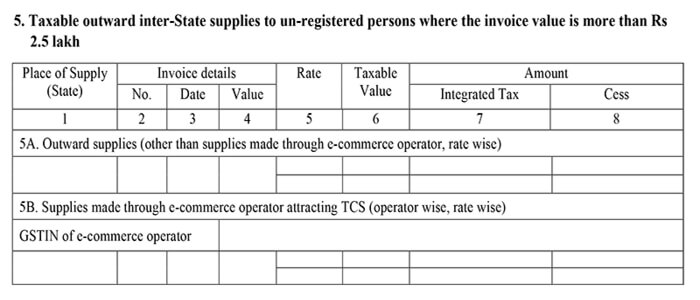

Section 5

Taxable outward inter-state supplies to the unregistered person in which the invoice value is more than 2.5 lakh rupees.

This section covers all the taxable supplies made to the large consumers (invoice amount of more than 2.5 lakh rupees) or unregistered persons.

5(A): Interstate supplies more than 2.5 lakh rupees is mentioned rate wise and invoice-wise.

5(B): Invoice detail to the supplies/sales made by the E-commerce operator to the unregistered person with taxable value, GSTIN of e-commerce operator, taxable value, etc.

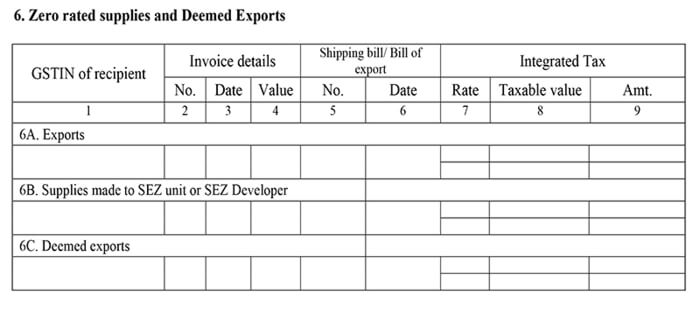

Section 6

Almost all Zero-rated supplies and deemed exports.

6(A) In this table, you have to fill the all export detail that made during the tax period such as invoicing detail, shipping bills, and detail of any taxes.

6(B): Supplies made to customers situated within a special economic zone(Sec developer or Sec unit).

6(C): In this table, you will have to fill the deemed export that you have done during the tax period. As per section chapter 1.1 of chapter 8.1 of the Foreign Trade Policy 2015-2020, these are transactions that are treated as exports, even if the goods have not yet gone out of the country. You may be providing the food to the export-orientated unit, a government-funded project, etc and getting the amount in Indian rupees or foreign money.

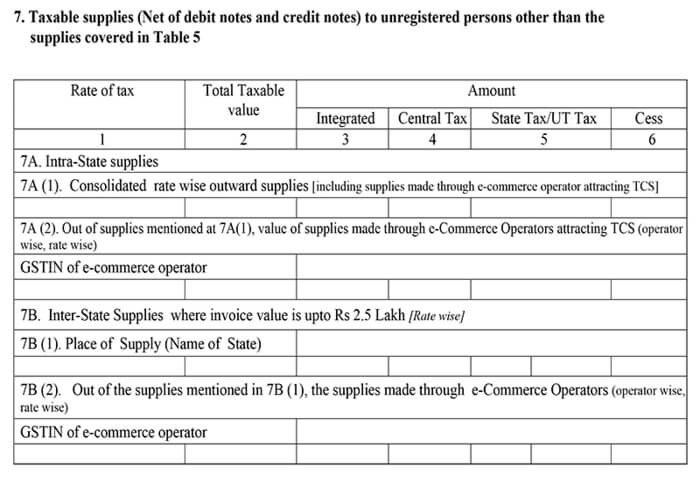

Section 7

Taxable supplies (net of debit notes and credit notes) to unregistered persons, other than supplies covered under Table 5:

All items in taxable supply accountability sold to an unregistered dealer will come into this section.

7(A): In this table, the taxable intra-state supplies to the unregistered dealer is filled.

7(A) 1: Under this section, the rate-wise summary of Intra-state supplies done to the unregistered person and through e-commerce operator.

7(A) 2: The operator-wise and rate-wise summary of supplies made in 7A (1) by e-commerce operator bringing the collection of tax at source.

7(B): In this table supplies less than 2.5 lakh rupees, as inter-state transactions to the unregistered person are filled.

7(B) 1: The state-wise and rate-wise summary of inter-state supplies less than. 2.5 lakh rupees.

7(B) 2: The rate wise and operator wise summary of sales introduced in 7(B)1 by the e-commerce operator for obtaining of tax at source.

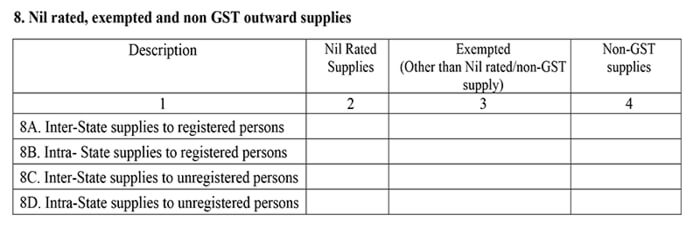

Section 8

Nil rated, exempt, and non-GST outward supplies

In this table, you have to fill the supplies if exempted, nil rated or non-GST items that are not mentioned in the above section. This section covers the separate details of inter-state supplies/intra-state transactions to a registered/unregistered person.

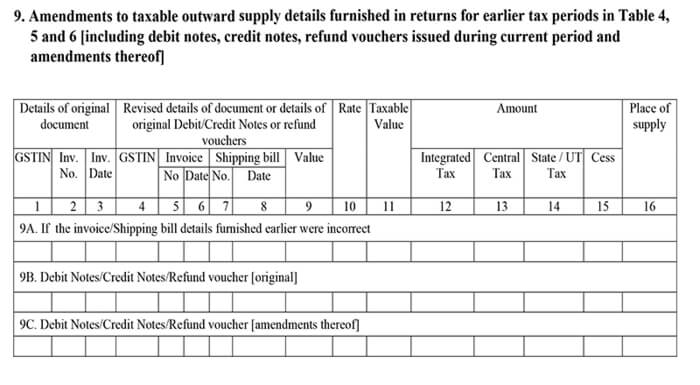

Section 9

Amendments to taxable outward supply details furnished in returns for earlier tax periods in table 4, 5 and 6

All the amendments to outward taxable supplies summary and the returns furnished for the previous tax intervals. Details of every other amendment in outward supply from earlier tax periods have to be reported under this section while an amendment in debit or credit note also requires being included in this section. If there be any changes in table 3, table 4, and table 6 from previous returns should be mention in this table. The table should be furnished as:

9A: If the previously filled details in table 6 were incorrect or non-available at the time of filing the returns, it should be mentioned here with identical shipping number and date

9B: In this table, the details of credit notes, debit notes, and refund vouchers needed to furnish.

9C: I this table the amendments while the earlier tax period to the debit notes/credit notes/refund vouchers should be furnished.

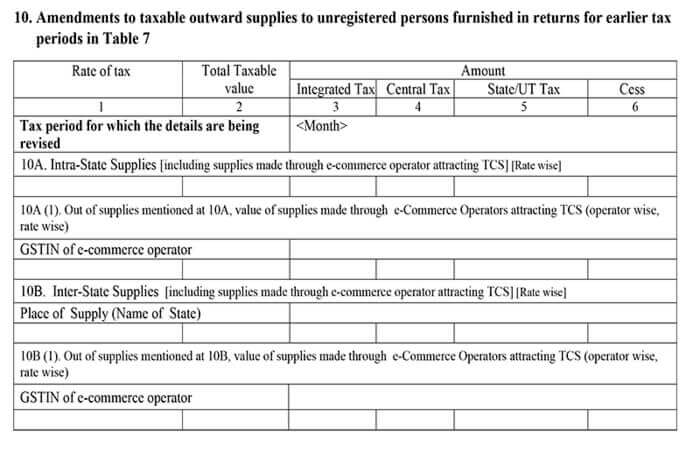

Section 10

Amendments to taxable outward supplies to unregistered persons provided in returns for previous tax periods in Table 7:

In this table, the details of the amendment of any taxable outward supplies made to an unregistered person from an earlier tax period should be included.

This is how to fill the details:

10A: In this table, you should fill the rate-wise details of credit notes/debit notes issued to an unregistered person for intra-state supplies.

10A(1): Under this section, separate details of supplies from 10A made through e-commerce operator is mentioned.

10B: In this table, the rate-wise summary of interstate supplies made to an unregistered person with an amount value of more than 2.5 lakh rupees is filled.

10B(1): In this table, the details of the interstate transaction from 10B made through the e-commerce portal have to fill.

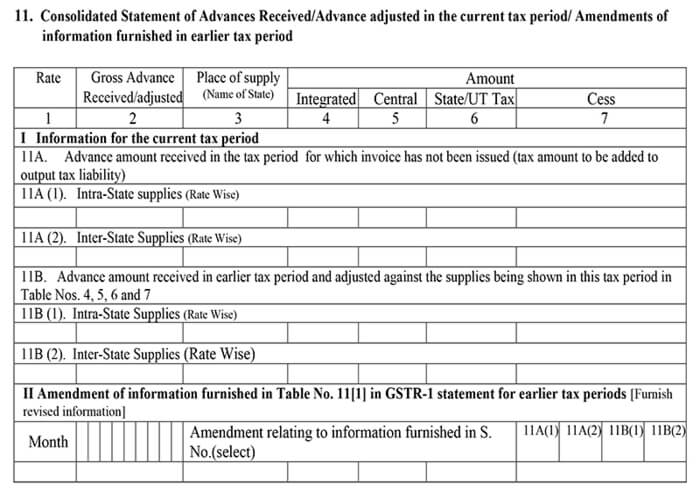

Section 11

Consolidated statement of advances received or adjusted in the current tax period, plus amendments of information provided in previous tax periods

In the section, the detail of advance received amount and invoiced in the current period is mentioned.

11 A: In this table, the detail of the advanced amount received without the invoice issued have to mention.

11 A(1): In this table, the rate-wise Intra-state transaction regarding 11A is mentioned.

11 A(2): under this table, the rate-wise inter-state transaction regarding 11A has to fill.

11 B: In this table, the detail of the advanced amount received previously and adjusted in this time at table number 4,5,6 and 7 is filled.

11B(1): In this table, the rate-wise intra-state transaction regarding 11B is mentioned.

11B(2): In this table, rate-wise inter-state supplies regarding 11B is filled.

Part 2 of table 11, revisions to the earlier tax period in table 11A and 11B.

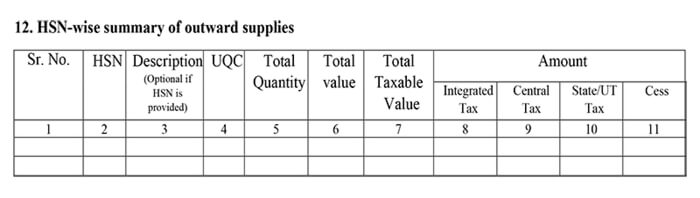

Section 12

HSN- wise summary of Outward Supplies

In this section, you have to mention the HSN code-wise summary of the sold item with the total number of items sold, total taxable value under every tax heading, and unit quality codes for import and export.

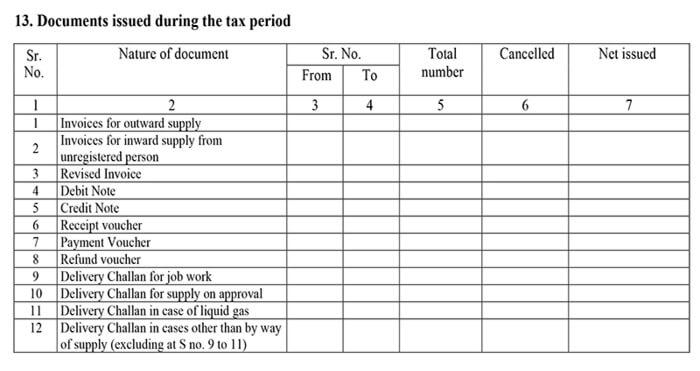

Section 13

Document issued during the tax period

In this section, you have to fill the detail of the invoice and document issues during the tax period with invoices for outward supplies, debit notes, credit notes, receipt vouchers, payment vouchers, refund vouchers.

It is believed that most people make mistakes while filing GSTR-1. So, one must always be well aware of all materials of any form.