Basic Of GST: GST Explained

GST Overview

Here the overview credentials belong to GST introduction, which summaries the Basic Of GST.

Basic of GST or call it GST basics India, both connote to the same thing.

Well, this all is somewhat called — “GST की मूल बातें”. Don’t panic, we will be discussing the entire GST information in detail, here only. However, we will be for sure considering the details of all above-mentioned amenities.

Apart from this all, our GST experts will take a closer look at your GST doubts. So, out-reach to our GST consultant:

Hire A GST Consultant @LeadingFile || Business Leading Innovation

LeadingFile has been here for many years, guiding clients and providing solutions for GST doubts through a hassle-free manner.

So, needless to say, speak with our certified GST CA to get tips, analysis and strategic planning that fits best to your needs. Whether you are a salaried employee or own a business, our GST experts at LeadingFile can help you in paying GST tax, invoice, compliances and in getting GSTIN with ease and from the comfort of your home or workplace.

Get in touch with us today…!!!

Coming back to the subject i.e Basic Of GST…

Dear audience, you know what – on July 1st, 2017 — India moved to a new tax system which was named; GST. And – what GST means? Ease: Goods and Services Tax: a tax reform which subsumes various indirect taxes into it and aims at converting the entire nation into a single market.

Going forth, if you’re new to GST and really wish to know how this new – GST will affect our lives in day to day life then this section is for you, keep going…

GST Terms: A Documentation On (A – Z) GST Basics

Avail the secrets of GST terms, here:

GST Basics: From GST History To GST Future [All Hits & Misses]

In order to conclude — GST basics or Basic of GST, let’s begin with the GST history…

To this, we at first consider making you aware of the GST (Goods and Services Tax) arrival date. It was…

1 July 2017/-

Yes, this was the only as well as the original date of GST launch. At the very date, the president, and the government of India after enhancing various GST laws – gave the green signal to GST.

Highlights Of GST Basics

- GST stands for — Goods and Services Tax; an indirect tax imposed in India on – 1 July 2017

- GST has completed its 2 years — back on 1 July 2019 and has improved its budget despite falling

- GST — subsumes 17 indirect taxes and a host of cesses which was levied under the previous tax regime

However, to recall the GST anniversary they marked 30 June and 1 July 2017 as the historic midnight.

But this wasn’t the real starting or so-called history of the GST. Really, then what in actual it is? Have a look, here…

History Of GST || GST History

The constitutional background of GST or call it the history of GST (Goods and Services Tax), utters that — it was something sixteen years back when the idea of GST for India, first time blinked. Something like – 1986; when the reform of India’s indirect tax regime was started by Vishwanath Pratap Singh (that time — finance minister of Rajiv Gandhi’s government).

Certainly, he only, at first came up with the introduction of the MODVAT (Modified Value Added Tax).

Later, the prime minister P V Narasimha Rao and that time FM (Finance Minister) Manmohan Singh, initiated a discussion on VAT (Value Added Tax) at the state level.

Upon this all, in 1999 – during a meeting between the Prime Minister Atal Bihari Vajpayee and his economic advisory panel, consisting of three former RBI governors (IG Patel, Bimal Jalan and C Rangarajan), proposed and gave a go-ahead to the single and common GST (Goods and Services Tax) law.

Thereafter, soon in 2000 – Atal Bihari Vajpayee organized a committee which was headed by that time finance minister Asim Dasgupta of West Bengal to design a GST (Goods and Services Tax) model.

Kinda off topic, the committee which was formed by the Prime Minister of India Atal Bihari Vajpayee, later in 2015 came to be known as the GSTN or GST Network or so-called Goods and Services Tax Network.

Coming back to the history phase; as you have looked, in 2000 – Vajpayee organized a committee to design the GST model. So, now the question is – who will look after this model. To this, in 2002 – the same government under Vijay Kelkar formed a task force to recommend the tax reforms.

And here comes the twist!

The twist of government and the final of BJP government. Yes, it was 2004 when the [simple_tooltip content=’BJP-led NDA; means the NDA (National Democratic Alliance) is led (assisted) by the BJP (Bharatiya Janata Party).’]BJP-led NDA[/simple_tooltip] government got defeat in the Lok Sabha election.

Onwards, the good time of the Congress-led UPA government began. This time the finance minister of Congress-led UPA government was P Chidambaram. He kept working on the same and proposed a GST rollout by somewhat 1st April 2010.

Time changed and in 2011, the head of the GST committee – Asim Dasgupta, resigned with the All India Trinamool Congress political party routing the Communist Party of India (Marxist) out of the power in West Bengal.

However, Asim Dasgupta in an interview, admitted that 80% of the GST task was completed by then.

Till then (something like 2014) the GST, hanged.

Another election, another party.

This time the snaffle was in the hands of BJP. Yes, in 2014 Lok Sabha election, the BJP (Bharatiya Janata Party)-led NDA (National Democratic Alliance) came into power. The government then and there [something like seven months back the formation of the then BJP (Modi) government] in 15th Lok Sabha, introduced the GST bill and got approval by the standing committee.

A year later to the formation of the then Modi government, in Feb 2015, Arun Jaitley set another deadline of 1 April 2017 to implement the GST (Goods and Services Tax).

Lookalike all was done.

Exactly! It was May 2016 when the Lok Sabha passed the constitution amendment bill and asked the government to make progress for GST.

But, it was a big – NO. Admirably, the GST bill got approval in the Lok Sabha. But, over the next phase, it got a stop signal from the Rajya Sabha.

The opposition was none other than the Congress. They asked to send back the GST bill for review to the select committee of the Rajya Sabha.

However, the review point was nothing big, it was just a disagreement on several statements in the bill relating to taxation. Literally, at this point – it seems to be like that the bill once again will be postponed.

But finally, in August 2016 – the constitution amendment bill was passed. And within the next 15 to 20 working days, 18 of the 29 states approved the bill. Also the president Pranab Mukherjee gave his approval to the GST bill.

Now, again the issue was – who will look after the law? This time, a 21-member ‘select committee’ was organized to look after the proposed GST laws.

Wherein, the laws or so-called bills like – CGST Bill (Central Goods and Services Tax Bill), SGST Bill (State Goods and Services Tax Bill), IGST Bill (Integrated Goods and Services Tax Bill) and UTGST Bill (Union Territory Goods and Services Tax Bill), after the approval of [simple_tooltip content=’GST Council; It is a governing body, containing 33 members.’]GST council[/simple_tooltip] were passed by the Lok Sabha on 29 March 2017.

Thereupon, the bill came to Rajya Sabha and got passed on 6 April 2017. Also, the bills were approved as Acts on 12 April 2017 by the Rajya Sabha.

At last, the state legislatures of different states passed respective SGST bills (State Goods and Services Tax bills).

And upon this all, the approval of various GST laws was made. Later to which the GST was launched all over India with effect from 1 July 2017.

Till it was lacking something, and what was that?

None other than the GST approval. Yes, it was lacking the approval of the GST Bill from the state Jammu and Kashmir. They approved but on 7 July 2017.

And now it was all done to GST. The end…!!!

Yes – it was the end of GST launching, now the GST (Goods and Services Tax) was live.

All right. But, If I say that the tax regime which was applied before the arrival of GST was quite good then why GST? Ease; have a look…

Why GST: The Need Of GST [By – GST Council]

Interesting question, and why it shouldn’t be — If we already have a way to file the tax then why GST?

Ease; here-out is the reasons of why do we need GST? All right, consider going with the pre-GST regime and if you find that complex then jump for the GST.

Quite Funny…!!!

Now, let’s consider the appropriate reason — (apart from the joke) — If you are a taxpayer then you might be knowing that the previous tax regime system involved: multiple taxes, the involvement of several state & central tax divisions, and the most complex compliance procedures, ever. This factor made the pre-GST system complex.

However, under the pre-GST system, it was highly difficult to set up and run a new business in India.

So, the left option is GST (Goods and Services Tax).

Not only this much but if you still don’t agree with the dual GST regime then have a look at the points, as follows:

Why GST Is Important: Reasons To Why GST

The basic of GST knowledge says that below illustrated are some of the basic reasons to why GST is important, as:

One Nation – One Tax – One Market

The first reason to why GST is — To make India: ONE NATION || ONE TAX || ONE MARKET.

Previous Indirect Tax Regime Was Complex

Another reason to why GST is here — Previous indirect tax regime was found quite complex.

Yes, in accordance with a survey from the GST council (made before launching the GST), peoples found indirect tax regime quite complex in comparison to the GST regime.

Literally, it was said that filing the indirect tax is the last job to do.

However, it was very hard to set up and run a business in India within the pre-indirect tax regime period.

Also, who likes to file more than hundred of taxes, if they are asked to file a single tax. And this tax is none other than the GST.

This is what, why the GST arrived. The theory didn’t end here…

Levied On All The Transactions Of Goods and Services

The final answer/reason to why GST, is as — It is levied on all the transactions of goods and services.

As of now, we all know that GST is known as — “Goods and Services Tax”. Apart from this, it is a tax regime or so-called reform which is levied on all the transactions like – sales and purchase, barter and transfer, rent and lease, import and export, etc of the goods and services.

So, if you are dealing with such amenities than you are required to look for the GST.

Needless to say, GST is important…!!!

Now, the question is what’s the structure of tax? Ease, keep going…

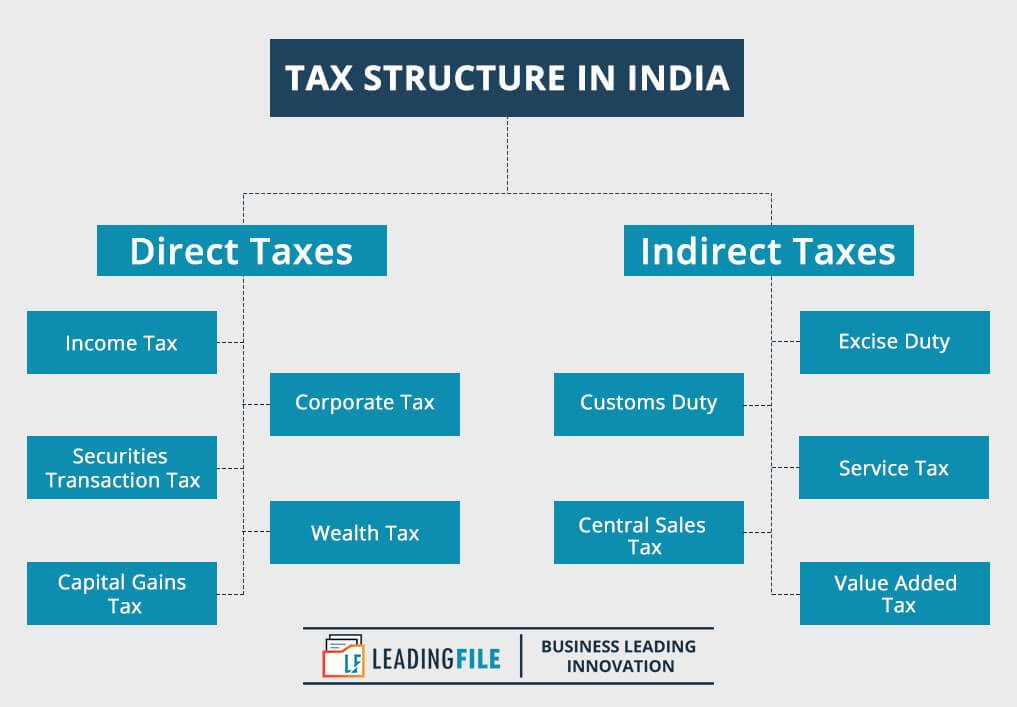

Tax Structure In India: An Overview Of Taxation In India

Admirably, in accordance with the knowledge of GST basics — the tax system of India has a well developed and organized tax structure, handled by the authority of central and state government along with the local bodies.

Wherein, the central government levies (collect) some of the direct taxes and some of the indirect taxes from the individual and commodities, itself.

Going forth, from all the type of tax reforms – the direct taxes in India which are collected by the authority of the central government are as follows:

- Wealth Tax,

- Corporation Tax, and

- Income Tax (Personal).

On the other hand, from all the type of tax reforms – the indirect taxes which are collected by the authority of the central government are as follows:

- Sales Tax,

- Service Tax,

- Excise Duty Tax,

- Custom Duty Tax.

What next, next is the time to know what state government levies? Have a look…

Certainly, the state government also levies (collect) some of the direct and indirect taxes from the individual and commodities, itself. And what they are? Ease; the taxes levied by the state government are as follows:

- Profession Tax,

- Stamp Duty Tax,

- State Excise Tax,

- Land Revenue Tax,

- Value Added Tax (VAT).

Now you might be looking at the local bodies, and must be thinking what local bodies levies? Don’t panic, here is what, they levy…

In accordance with the basic of GST — the tax structure in India says that the local bodies are empowered to levy a tax on the following components of tax:

- Octroi,

- Drainage,

- Water Supply,

- Properties, etc.

And to all this taxes reform, the GST is only applicable on the [simple_tooltip content=’Indirect Taxes are: Excise Duty Tax, Customs Duty Tax, Service Tax, Central Sales Tax, Value Added Tax (VAT), etc.’]indirect taxes[/simple_tooltip]. Because – GST is an indirect tax.

Got it or it was all like round and round?

Ok, STOP…!!! Have a look from the beginning, again…

→ The tax structure of India says that the tax is classified into two types (components) – one is [simple_tooltip content=’Direct Tax In India are: Income Tax, Wealth Tax, Corporation Tax, Securities Transaction Tax, Capital Gains Tax, etc.’]“Direct Tax”[/simple_tooltip] and another is [simple_tooltip content=’Indirect Tax In India are: Excise Duty Tax, Customs Duty Tax, Service Tax, Central Sales Tax, Value Added Tax (VAT), etc.’]“Indirect Tax”[/simple_tooltip].

On the next level, this tax reforms (direct and indirect) is levied by the two authorities – one is “Central Government” and another is “State Government”.

But, these authorities were not enough to collect the whole tax reforms. So, a local authority was created by the government, and it was named – “Municipality”. This authority was responsible for collecting minor taxes.

Wherein, the central government collects both the taxes reform – direct and indirect taxes as well. Similarly, the state government also collects both the tax reforms.

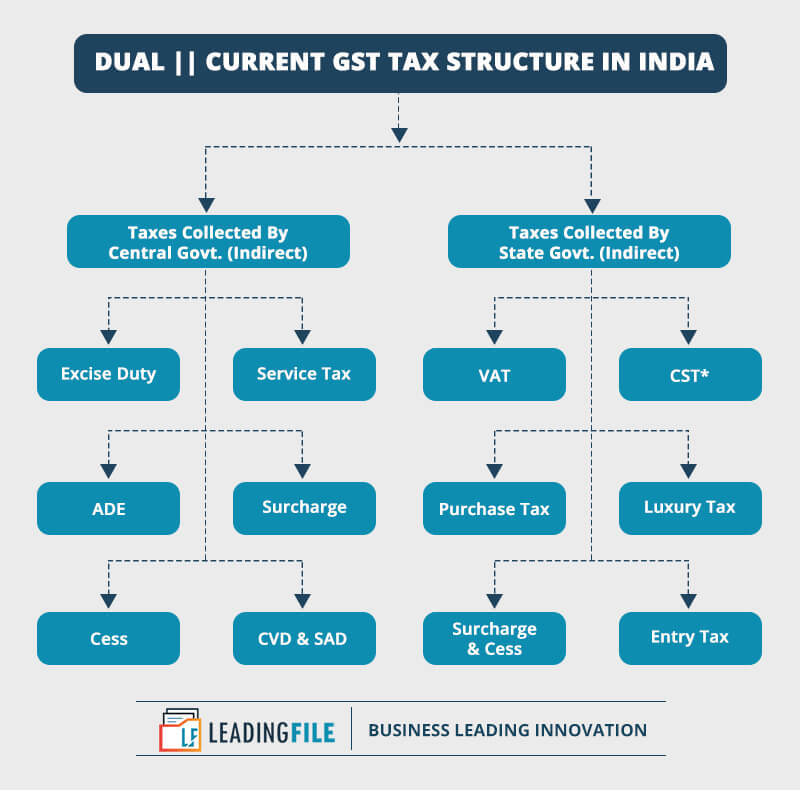

But, the current or dual GST tax structure in India says that only the indirect taxes are to be collected. So, might it be the central or state government – if it collects the indirect tax then it will fall into the [simple_tooltip content=’GST Tax Structure Slab: Zero Rate, Lower Rate, Standard Rate, Higher Rate and Additional Cess.’]GST (Goods and Services Tax) slab[/simple_tooltip].

Understand it through an image, here…

→ The indirect taxes which are levied by the authority of the central (Central Tax) and state (State Tax) government are as follows:

Also, this taxation in India (tax structure) has undergone tremendous reforms during the last decade. Have a look:

| Previous Tax Structure In India | Present Tax Structure In India |

Transition to GST is as follows…

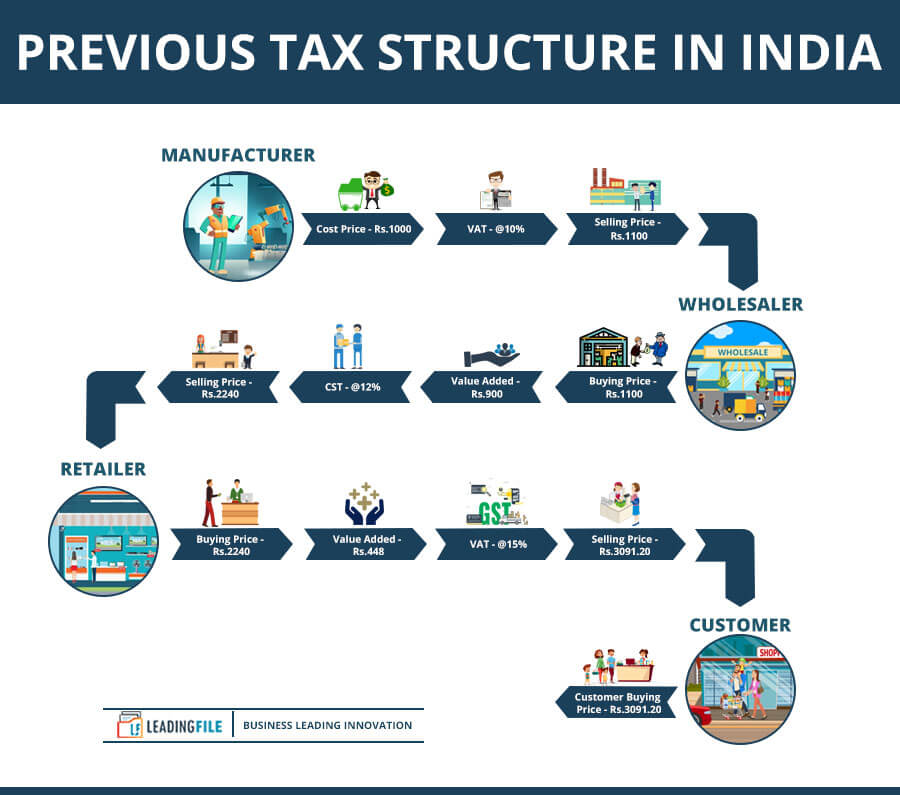

Previous Tax Structure

What do you think of pre-tax structure? Simple, Easy, cheap – that type. In actual, it is not so and so. The previous tax structure of India was quite complex and was not a bit cheap.

Have a look…

That time tax structure says if a manufacturer produces an item for Rs 1000 then after including VAT of 10% he will sell it of Rs 1100 to the wholesaler.

Thereafter, the wholesaler will add some value of Rs 900 to that item and also a CST of 12%, and then will sell it for Rs 2240 to the retailer.

Now, the retailer after adding some value of Rs 448 and a VAT of 15% to that item, will sell it for Rs 3091.20 to the customer. Have a view of the same, here…

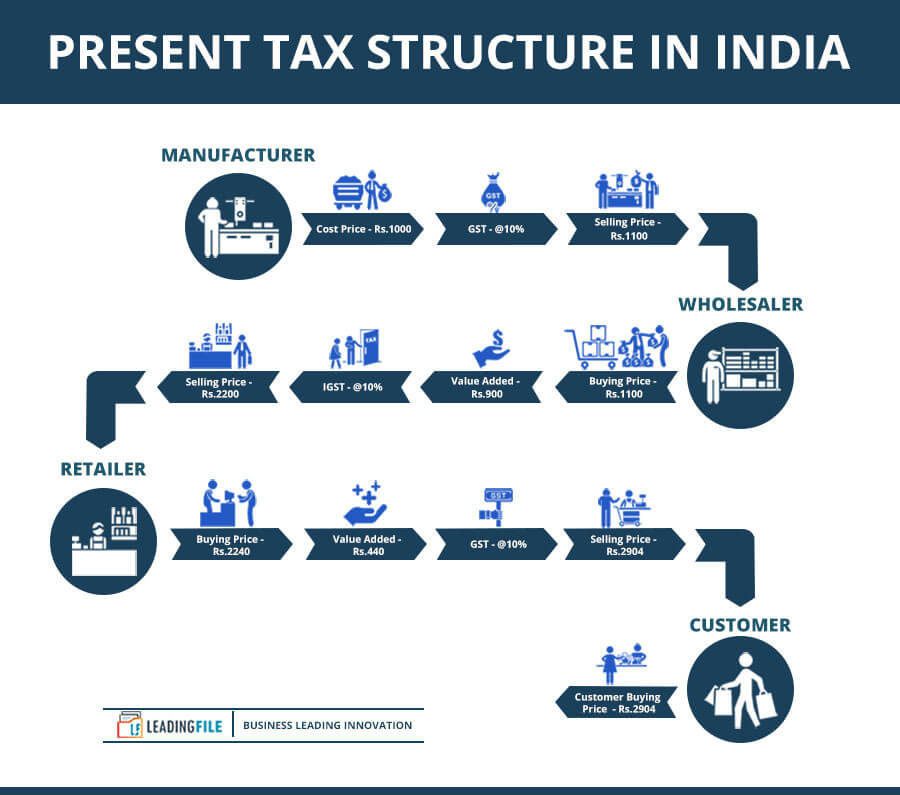

Present Tax Structure

Believe me…!!! It is – easy, money-saving and the most flexible. Don’t you think so? Come and have a view of the same;

This time or current GST tax structure says if a manufacturer produces an item for Rs 1000 then after including GST of 10% he will sell it of Rs 1100 to the wholesaler.

Over the next phase, the wholesaler will add some value of Rs 900 to that item and also an IGST of 10%, and then will sell it for Rs 2200 to the retailer.

And to the last phase, the retailer after adding some value of Rs 440 and a GST of 10%, will sell it for Rs 2904 to the customer. Have a view of the same, here…

Thinking changed? If so, then go for the GST Registration — Today @LeadingFile || Business Leading Innovation.

Register For GST, Here…

Also, Avail Our Secret Principles At GST, &

Maximize Your Business Value: In Easy & Effective Manner, Today @LeadingFile #GST Registration.

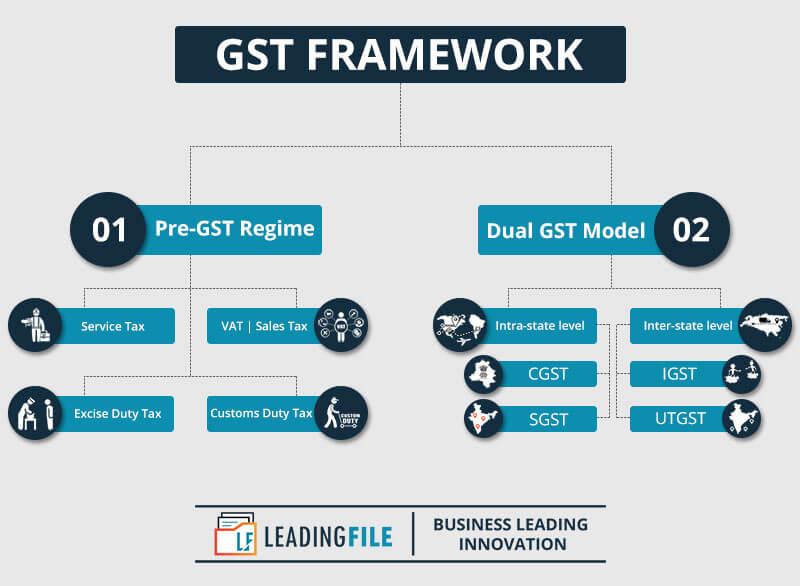

GST Framework: Graph The Framework Of GST In India

All right, to understand the framework of GST – have a quick view of the infographics, as —

Now, let’s consider the subjective view of the same -> The GST framework in India as per the new law is expected to replace the complete [simple_tooltip content=’pre-GST regime: A regime which consider going with the following taxes – VAT (Value Added Tax), Customs Duty Tax, Excise Duty Tax, CST (Central Sales Tax), Service Tax, Entertainment Tax, Central Excise Duty, Duties of Excise, Cess, State VAT, Purchase Tax, Luxury Tax, Entry Tax, Taxes On Advertisements, Taxes On Lotteries, Betting, and Gambling, etc.’]pre-GST regime[/simple_tooltip] with a single tax reform or regime named the GST (Goods and Services Tax).

So, let’s evaluate the same [The theory of GST Framework] — GST framework is classified into two basic GST parts: “pre-GST regime” and “post-GST regime” or so-called “dual GST model” or simply the “dual GST”.

Wherein, the pre-GST regime itself is classified into four (4) basic parts: Octroi Tax, Service Tax, VAT | Sales Tax, and the last Customs Duty Tax.

On the other hand, the new law or name it dual-GST tax structure or dual-GST regime or dual GST model – is classified into two (2) basic parts: Intra-State Level and Inter-State Level.

To this level of dual GST, the intra-state level is classified into two sub-parts: CGST (Central Goods and Services Tax) and SGST (State Goods and Services Tax).

Similarly, the level of dual GST on behalf of the inter-state level is also classified into two sub-parts. IGST (Integrated Goods and Services Tax) and UTGST (Union Territory Goods and Service Tax).

Going forth, classify your tax reform level and file under the same with the best GST attorney.

Way-apart, have a view of the future of GST in India…

Future Of GST In India: A Report By GST Council

GST council meeting says that the future of GST in India is translucent clear and bright.

To address this, President Ram Nath Kovind from the parliament said that the government will simplify the GST (Goods and Services Tax) in the very FY (Financial Year).

Not only this much but he also said that — an important step in this direction is the exemption to persons earning up to Rs 5 lakh from the payment of IT (Income Tax).

Moreover, in accordance with a survey from the GST council, the future of GST (Goods and Services Tax) in India is completely economy friendly.

But, to make it more friendly – the council is thinking to reduce the number of tax slabs. Going forth, the council came up with a suggestion that the GST tax slabs, including zero rate, should be re-categorised into three slabs.

To this, Arun Jaitley said; re-categorization of GST tax slabs will lead to a huge loss of revenue to the government of India. Conversely, he said that a gradual (moderative) reform to this categorization will be beneficial and even will not have any negative impact.

Also, there is no negative impact of GST in India. If it’s so then you might be thinking — what is the impact of GST in India? Ease; from the true and white the impact of GST in India is on its economy.

Literally, the impact of GST on economy of India is like “Icing on the cake”.

The report from the council didn’t end here. Even it is not the starting too. In order to have the depth overview of the future of GST in India, keep going…

Let’s start from a question → What you think – this is the end of GST? If yes, then wait, you will be disappointed soon.

In accordance with the 35th meeting of the GST council, it is completely transparent that this is not the end of GST.

An answer to this is — GST is still a work in progress. Address to this is, amendments made in the GST rules. Yes, in the very meeting of the GST council, 90 amendments were made in the GST rules.

Also, the council is about to roll out a new GST return filing system on or before October 1 of the very year (2019). This GST return filing system will enable the trader to file the tax returns in a single format despite the multiple and at once only.

Over priority, international business community will welcome this landscape change of India’s business. Even, the community agreed that the GST has improved the ease of doing business in India.

In address to this, the business and FDI (Foreign Direct Investment) of India is about to grow like never before.

Conclusion Of GST: The End For A New Start

PM Modi once from the Lok Sabha said — GST (Goods and Services Tax) is going to make the dream come true of “Ek Bharat, Shrestha Bharat”.

And the conclusion of GST says that the words of PM Narendra Modi are going on the right way. As of now, the GST has travelled a long way of 2 successful years and has been till improving the score of the budget despite falling.

Specifically, the expert’s conclusion for GST is — one day GST will subsume all the direct taxes, too.

Also, the objectives of GST is to improve the competitiveness of the goods and services which auto will improve the GDP rate.

To this, the GST conclusion utters that GST has made India’s economic growth the fastest growing economy in the world. However, the economy of India is growing as never before.

Certainly, it is no secret that the launching and implementation of GST (Goods and Services Tax) is the best decision, taken by the government of India.

As a result of this decision, GST is the most accepted and appreciated tax reform in the whole country. After all, it does away a taxpayer with the filing of multiple taxes.

So, needless to say, register for GST (Goods and Services Tax), today @LeadingFile || Business Leading Innovation.

![Why GST: The Need Of GST [By - GST Council]](https://www.leadingfile.com/wp-content/uploads/2019/07/Why-GST-300x100.jpg)