How To Download GST Registration Certificate From gst.gov.in Government Portal

- December 30, 2019

- Posted by: Editorial Team

- Category:

GST is one of the major changes in the field of tax. It is a kind of revolution in the field of tax in India. The old tax system(VAT) has been removed to bring a single uniform indirect tax structure in India i.e. GST. Under the GST act, every business owner or taxpayer whose annual turnover is above INR 20 lakhs has to register themselves (INR 10 lakh for Northeastern states). Many taxpayers want to know how to download the GST registration certificate from the India GST portal. So here we will know all about the GST registration certificate.

An Overview of GST Registration Certificate

Like any other legal registration certificate, there is also the Goods and Services Tax (GST) Registration Certificate, which is essential for any taxpayer in India, including the non-resident Indians (NRIs). The GST Certificate is mainly issued and authorized by the Goods and Services Tax Network (GSTN) as per the regulations of the Goods and Services Tax (GST) Revised Act, 2017. Also, there is no fee imposed – you can easily apply for GST Certificate online without having to pay any fees or hidden charges. When you complete the one-time online registration process, you will receive a soft copy (electronic copy) of your GST Certificate.

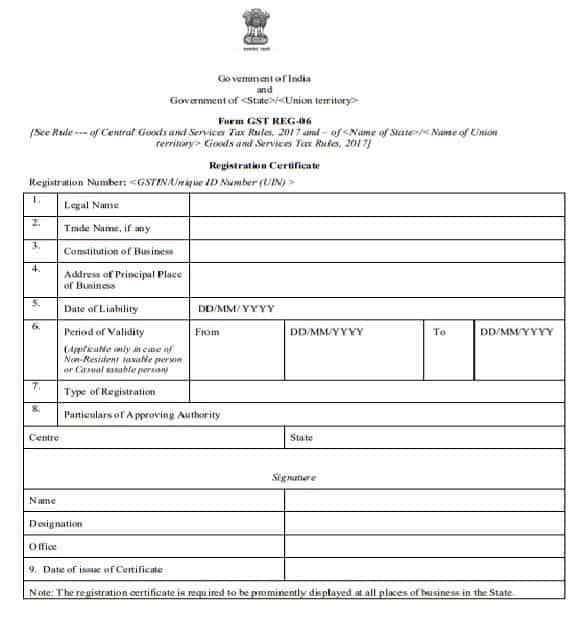

Generally, the GST Registration Certificate, which is contained in Form GST REG-06, consist of details given as under:

- Legal Name of Business

- Trade Name

- Type of Registration

- Principal Place of Business

- Additional Place or Places of Business

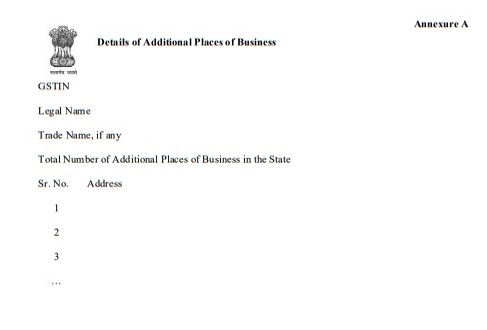

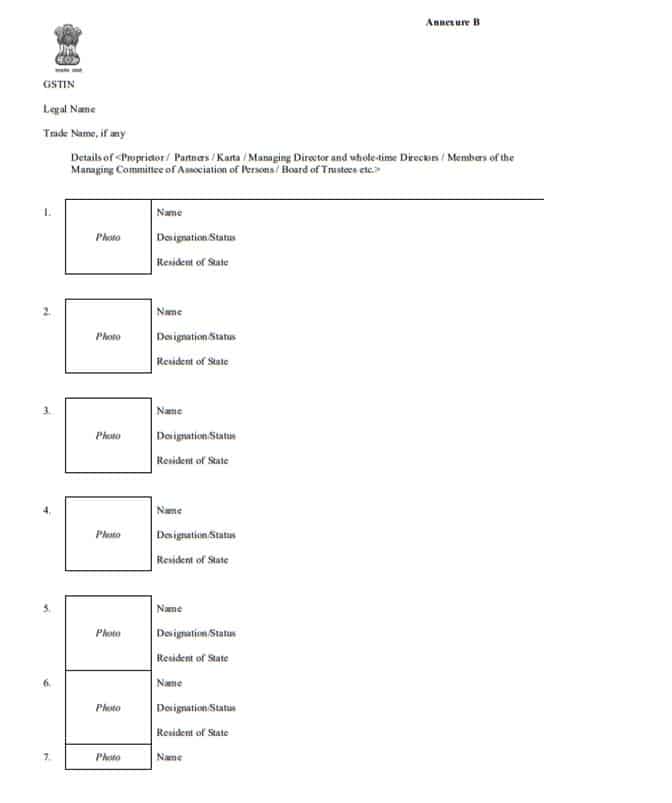

The GST Registration Certificate has several pages that require necessary information to be filled in by the taxpayer. The first page is basically a fundamental section of the form that contains vital information about the taxpayer’s business. The second page of the form in ‘Annexe A’ consists of information of the taxpayer having an additional place or places of his/her business establishment. Likewise, the third and final page of the form in ‘Annexe B’ contains information of the person who is in charge of the respective business, such as a managing director, etc.

The GST Certificate of Registration is available in PDF format only and any person who is registered under GST can download it. However, what is different here is that a registered person can only download the GST Certificate after signing in with his/her login credentials.

Therefore, the purpose of this guide is to show you how to download the GST Registration Certificate from the official government portal https://gst.gov.in.

Process to Download GST Registration Certificate

If your registration is successfully completed for GST, you can download the GST registration certificate for goods and services tax in very simple steps. The complete process to download the GST registration certificate as follow:

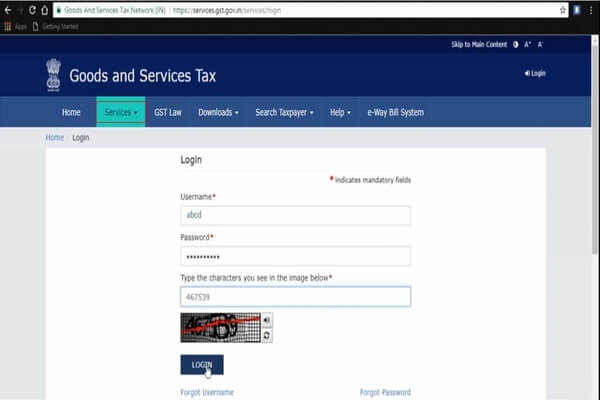

Step 1: First of all, go to the India GST portal and click on the “Login” option or follow this link https://services.gst.gov.in/services/login

Step 2: Fill your username, password & captcha to login

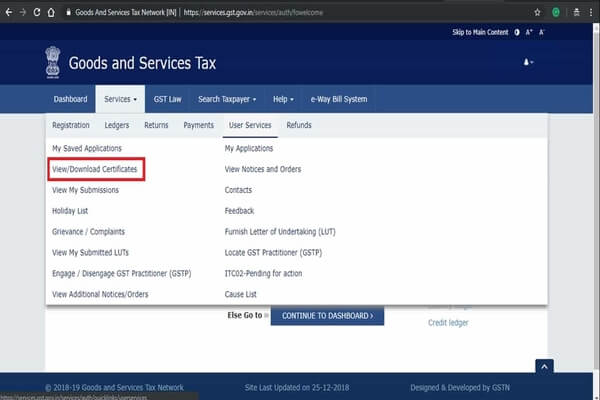

Step 3: After login, the dashboard will open, go to ‘Services’ option>‘User Services’ option >‘View/ Download Certificate.

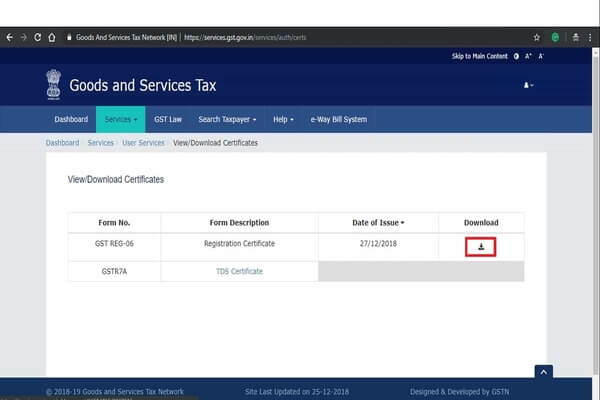

Step 4: At last a table with Form No., Form Description, and Date of Issue will be shown. You have to click on the “Download” option.

The GST registration certificate will be downloaded in the system.

Note: The download of a GST registration certificate without login in the GST portal is not possible. Sometimes It is necessary to login to your profile for security reasons to download anything on the internet. However, the downloads of GST registration certificate steps is given above.

Sample of GST Registration Certificate

The GST registration certificate i.e Form GST Reg – 06 contains all the detail of the business. The first-page contains basic details such as legal name, trade name, constitution of business, address of principal place of business, date of liability, period of validity, type of registration, and date of issue of the certificate.

The second page i.e. ‘Annexure A’ contains all the detail of any additional address of the business.

The third page i.e ‘Annexure B’ contain the detail of partner/ managing director and whole-time director/ (that is the person in charge of Business) (Name, designation status, place of residence of the state along with the photographs)

The Validity of the GST Registration Certificate

The GST registration certificate which is assigned to the normal taxpayer do not have expiry. It would continue to valid until the GST registration is not canceled or surrendered by the goods and services tax authority.

But for the casual taxpayer or non-residential taxpayer, the validity time is a maximum of 90 days. After 90 days the validity time can be extended or renewed.

How to make changes in GST Registration certificate

Sometimes, there are mistakes happens during the fill of GST registration. To make changes in GST registration certificate follow the following process:

Step 1: First of all, you have to log in to the India GST portal and go to Services > Registration > Amendment of Registration Core Fields.

Step 2: Form GST REG-14 will open. Fill the necessary changes on this form with the supporting documents and submit it.

Step 3: This type of application for such changes can be approved within 15 days after verification and procedure for changing information can be accepted or rejected by the tax officers.

Step 4: Approval will be given in Form GST REG-15 for such changes or if the form will be rejected then the officer can provide notice in Form GST REG-03 for inquiring information.

Step 5: If the officer wants more clarification under Form GST REG-03, then it is needed to submit such details in Form REG-04 within 7 days.

Step 6: At last after the verification of the above details, an officer can accept the change in step 3 or reject the application for change by issuing the Form GST REG-05.

Fees of GST Certificate

There are zero fees for the GST certificate. You can apply for a GST certificate through the India GST portal without any fees. Once your registration is successfully completed, you will receive a soft copy of the GST certificate.

How and Where to Display GST Certificate

The GST Certificate which a registered taxpayer receives contains a GSTN (Goods and Services Tax Number). This GSTN can be used or displayed on a plate/name board, for instance, at the taxpayer’s primary place of business, such as a retail store, etc.

The CGST rule states that the GST Certificate is shown which binds the taxpayer. Thus, according to CGST Rule 18(1) of the GST Act, 2017, the GST Certificate shall be displayed in a remarkable location at the principal place of business. Also, the person registered for GST must display the GST Certificate at every newly added place(s) of his/her business.

Also, according to CGST Rule 18(2) of the GST Act, 2017, the taxpayer must a plate/name board at the entrance of his/her principal business place(s) which contains the Goods and Services Tax Identification Number (GSTIN).

GST Registration Certificate Expiration

The GST Registration Certificate that is issued to the taxpayer (NRI included) by the government of India is valid for a period of 90 days only. This can also be counted from the date of registration for GST or for a period that is specified in the application of the GST registration, whichever is earlier.

However, it is also possible for a taxpayer to extend the period of validity of the GST Registration Certificate to a couple of days more. This can be done through the assistance of an authority. You may refer to Section 27(1) of the GST Act, 2017 for more information on extending the time period/validity of your GST Registration Certificate.

The GST Registration Certificate is, in fact, a very significant and useful instrument that can serve a lot of purposes to a taxpayer.

Conclusion

The download of a GST registration certificate is necessary for every taxpayer in the premise of the business declaring that the business is “GST Registered Business.” GST certificate should be ready at any time or any point on the premises of the business.