www.ewaybillgst.gov.in: Government E-Way Bill Portal GST Login & Register Guide

- January 7, 2020

- Posted by: Editorial Team

- Category:

Basically, e-Way Bill (EWB) is an electronic Way Bill, which is a unique bill or document that is generated online to be used by taxpayers and transporters, primarily for the purpose of transporting goods or consignment, especially from one location to another. Thus, under the newly revised Goods and Services Tax (GST) regulations, an e-Way Bill is required when goods are to be transported from the consignor to the consignee, whether the delivery takes place in the inter-state or intra-state level and that the value of the goods is over Rs. 50,000.00. The same regulation also applies if the person is transporting the goods for his or her personal use and that the goods are valued at more than Rs. 50,000.00.

How To Register and Login To the e-Way Bills Portal – A Simple Guide

The newly revised Goods and Services Tax (GST) regulations as of 23rd March 2018 has mandated the generation of e-Way Bills, which became effective since 1st April 2018. The e-Way Bill is an electronic Way Bill that can be generated online on the e-Way Bills portal/website only. The portal is officially launched under the initiative of the government of India.

However, please be aware that you cannot log in to the e-Way Bills portal without first registering yourself on the website. Therefore, in the following section, we will guide you through the steps that are required to register online on the e-Way Bills portal and login to access the various features or services that are offered to individuals and business owners.

Steps to Register to e-Way Bills Portal

Follow the steps given below to register online on the e-Way Bills portal and login to use the services.

Step 1: On your desktop PC or laptop, or smartphone or tablet device, open a web browser and go to the website https://ewaybillgst.gov.in.

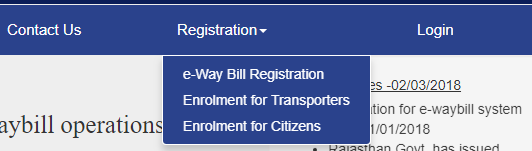

Step 2: When you are on the website, you will find the Registration link on the top menu. Click the link and follow the on-screen instructions to get registered on the e-Way Bill system portal.

Step 3: During the registration process, you will be asked to provide your GSTIN (Goods and Services Tax Identification Number) number and then verify the Captcha code displayed on the screen.

Step 4: In this step, you will be asked to provide necessary details, such as the applicant’s name, trade name, complete address with pin code, mail ID, and mobile number. After entering the required details, click the Send OTP button to receive a code on your phone.

Note: You will receive an OTP (one-time-password) on the mobile number which you have provided here.

Step 5: Enter the OTP code that you received on your phone in order to complete the registration process on the e-Way Bills portal.

You will be successfully registered on the e-Way Bills portal. You will also be able to login to the e-Way Bills portal and access services related to GST.

If you are a transporter, then you will be required to choose the “Enrolment of Transporters” option in order to register on the e-Way Bills portal.

Steps to Login to e-Way Bill System Portal

After you have successfully registered yourself on the e-Way Bills portal, you must log in to carry out the necessary tasks.

Follow the steps given below to login to the e-Way Bills portal so as to use the services.

Step 1: On your web browser, go to the website https://ewaybillgst.gov.in.

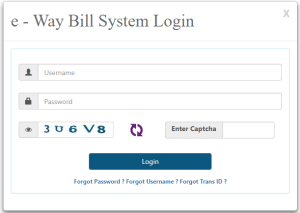

Step 2: Click the Login button located on the top right of the page.

Step 3: The e-Way Bill System Login page will appear. Here, you are required to enter your username, password, and the Captcha code, then click the Login button to proceed.

Note: Your username and password are credentials that you created during the registration process.

Step 4: After providing the correct username and password at login, you will be automatically redirected to the Dashboard that will allow you to access various services and carry out tasks as per your needs. On the Dashboard, you will see services such as:

- Generate New – Use this service to generate a new e-way bill. You will be asked to provide the necessary details during the procedure.

- Generate Bulk – Use this service to generate multiple e-Way Bills in a single entry easily.

- Update Part B/Vehicle – Use this service to choose your preferred method of transportation by which all the goods/consignment will be transported from one place to another.

- Update Vehicle-Bulk – Use this service to update multiple transporting details with different e-Way bills.

- Change to Multi-Vehicle – Use this service to fill details of multiple conveyances or transportation mediums in a single entry.

- Extend Validity – Use this service to easily extend the validity period of an e-Way Bill, in case the delivery of consignment/goods is late.

- Update EWB Transporter – Use this service to update the details of transportation, in case changed in between.

- Update EWB Trans-Bulk – Use this service to update details of the transporter in a single entry, instead of having to do it in multiple entries.

- Cancel – Use this option to cancel an e-Way bill that you had already generated not more than 24 hours ago.

- Print EWB – Use this option to print an e-Way Bill (EWB) quickly. Please note that the EWB number is required in order to print an e-Way Bill.

This is all the steps that you will require in order to successfully log in to the e-Way Bills portal and access the services you want right from the Dashboard.