GST Registration Process Online – How to Register for GST Step by Step

- January 8, 2020

- Posted by: Editorial Team

- Category:

The most crucial reason why registering online for GST is essential is that it saves you from the hassle of physically visiting the Income Tax Department, which may be very far from your residence. The other reasons include easy and quick registration process on the Internet from the comfort of your home.

You will be glad to know that the process of GST registration online is not a difficult task. You can easily achieve this using any device that has a web browser and an active Internet connection. People today are quite busy and may not have time to spare sometimes. Hence, the need for online GST registration came into being, which is an initiative started by the government of India recently.

When you register online for Goods and Services Tax (GST), you will be provided with several services that will allow you to file your tax returns, track status, generate invoices and bills and much more. So, it is essential that you register online for GST and avail of the services easily.

In this article, we will provide you with a complete guide on how to register for GST online and the documents that you will require in order to successfully complete the GST registration process online.

GST Registration Process Step by Step

If you are new to the GST portal/website and need help with the online registration process, then this step-by-step guide is what you will need to achieve your task. The process involved in applying and registering for GST online is a straightforward procedure and thus, does not require hard copies of your documents. This is completely an online and paperless process. You will, however, need scanned copies of certain vital documents that may be submitted online via the GST Registration form. This process will surely save you plenty of time and effort.

Given below are steps that are required in order to register for GST online, which will further allow you to access essential services in relation to Goods and Services Tax (GST).

Steps 1: To begin with, open a web browser and go to the website https://gst.gov.in. If you are using a search engine, such as Google or Bing, etc., then look for the link as mentioned here. This is the official website/portal of the government of India Goods and Services Tax (GST).

Note: You can access the website from your desktop PC, laptop, tablet or smartphone and that has an active Internet connection (Ethernet/LAN, Wi-Fi or Hotspot). Supported web browsers are Firefox, Chrome, Edge, and Safari.

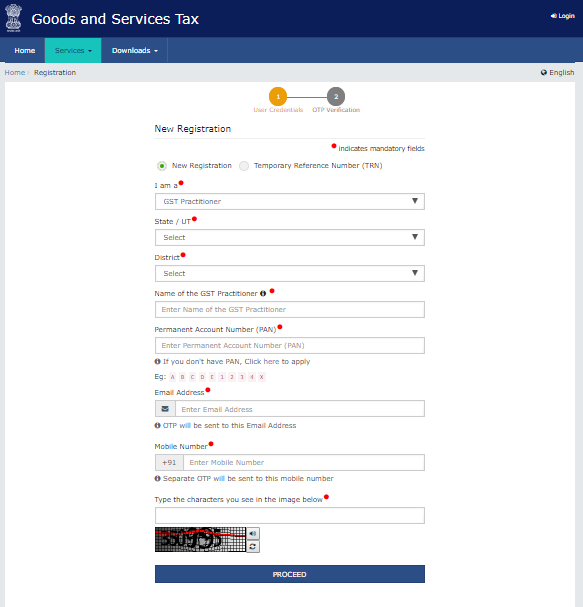

Step 2: When you are in the GST portal, click the Services menu at the top bar, then click on the Registration link and click again on the New Registration option. You will be redirected automatically to the GST Registration page to complete the online registration process.

Step 3: The online GST Registration Application page is divided into two parts, namely Part A and Part B, which are required to be filled by you if you are a taxpayer, transporter or individual.

Note: Here, you will see the New Registration and Temporary Reference Number (TRN) options with radio buttons.

GST Registration Online Form – Part A

Step 4: The New Registration radio button will be automatically selected for you since you are applying for a new GST registration. Also, note that the fields with a red asterisk mark indicates that these are mandatory and details must be provided.

Note: At the top of the New Registration form, you will see the User Credentials and OTP Verification sections. The details which are required to be filled by you as a taxpayer are stated as under:

Step 5: In the “I am a” field, select from the drop-down list box the option that fits you best. For instance, if you are a taxpayer, then select the Taxpayer.

Step 6: In the State / UT field, choose your desired place of origin or state from the list box provided.

Step 7: Enter the name of your district for the state that you have selected (optional).

Step 8: In the Name of your Business field, you are required to provide the name of your business that matches on the PAN card.

Step 9: Next, you must enter your PAN number in the Permanent Account Number (PAN) field.

Step 10: You are also required to provide a valid e-mail address that you commonly use.

Note: Your valid e-mail address is needed in order to receive an OTP code which will be sent to the e-mail address that you have provided here.

Step 11: Lastly, you must provide your valid phone number in the Mobile Number field.

Note: This is needed so that you will receive an OTP code separately on the phone number that you have provided in the online GST Registration form.

Step 12: After entering all the required details in the online GST Registration form, click the Proceed button at the bottom to continue.

Note: This process could take a moment.

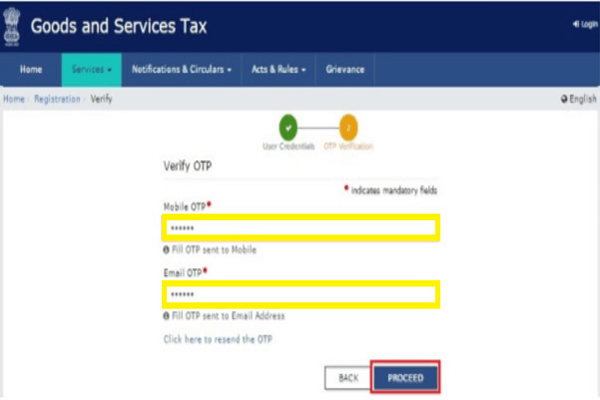

Step 13: You will now be redirected to the OTP Verification section of the online GST Registration form that is displayed on your screen.

Step 14: In the Verify OTP page, you are required to enter the OTP code in the Mobile / Email OTP field that was sent to you on the mobile number and e-mail address you provided in the online GST Registration form.

Note: In case you did not receive the OTP code on your phone and/or e-mail address, you may click the link Need OTP to be resent? Click here. You will be sent the OTP code again. The OTP code is usually valid for 10 minutes only, after which it is rendered expired.

Step 15: After you have entered the OTP code in the required field, click the Proceed button to continue. Wait for the process to complete.

GST Registration Online – Part B

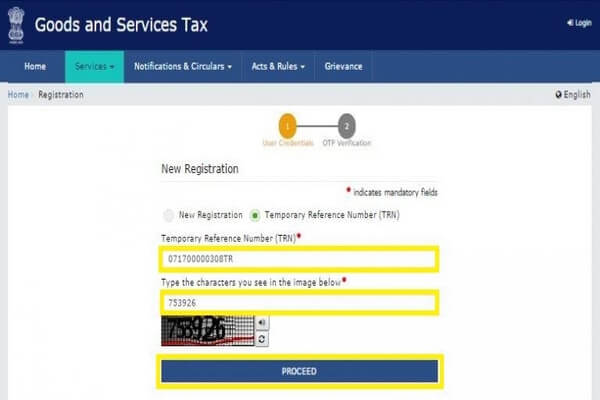

Step 16: After the OTP Verification process is completed successfully, the system will automatically generate a Temporary Reference Number (TRN) for you, which will be displayed on your screen.

Step 17: Click the Proceed button again.

Step 18: You will be redirected to the New Registration page again, where this time, you must ensure that you selected the Temporary Reference Number (TRN) option at the top.

Step 19: In the Temporary Reference Number (TRN) field, you must provide the TRN that was generated for you previously, then complete the Captcha code that is shown on your screen and click the Proceed button to continue.

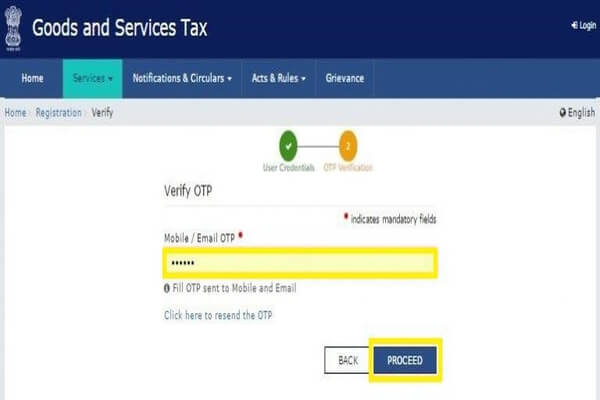

Step 20: Upon clicking the Proceed button, the OTP Verification page will be displayed again on your screen. This time, you will receive a different OTP code, both on your phone and e-mail address.

Step 21: Check your phone and e-mail, where you have received the OTP code and enter it in the Mobile / Email OTP field.

Note: The OTP code sent to your mobile number and e-mail address will only be valid for 10 minutes.

Step 22: After entering the OTP code, click the Proceed button again and wait for the verification process to complete.

Step 23: When the OTP Verification process is successfully completed, you will see the My Saved Application page displayed on your screen. You will be given a time period of maximum 15 days in order to submit your application online along with the correct details.

Step 24: Here, under the Action column, click the Edit icon (with a blue square and white pen) and follow the next steps to fill your GST Application form.

Guide to Filling GST Application Form Online

When you have obtained your Temporary Reference Number (TRN), you will then be required to fill the GST application form.

The GST Application form with several options in tabs will be displayed on your screen. One by one, you will be required to provide necessary details for each of the options in the tabs. The various options displayed in tabs include:

- Business Details

- Promoter / Partners

- Authorized Signatory

- Authorized Representative

- Principal Place of Business

- Additional Places of Business

- Goods and Services

- Bank Accounts

- State Specific Information

- Verification

These options mentioned above are accessible from your Dashboard. We will now guide you through the steps in the following sections of our how to register for GST India online guide.

List of Documents Required for GST New Registration

Before you start filling the GST application form online, it is advised that you have scanned copies of the documents listed below:

- A valid net banking details, such as bank account number, name of the account-holder, IFSC code, etc.

- Proof of constitution or incorporation of your business

- Deed of Partnership (in case your business has partners)

- Registration Certificate of the business entity

- Proof of primary place of business

- A passport size photo of the director, partner, promoter or the head member of the Hindu Undivided Family (HUF)

- Proof of appointment of Authorised Signatory

- A passport size photo of the Authorised Signatory

- A scanned copy of the bank passbook (either front or first page) or bank statement which contains the required information, such as bank account number, account holder’s name, address, latest transaction details, etc.

Once you have the scanned copies of all the pre-required documents stated above, you may proceed with filling the online GST Application form for all the given tabs on your Dashboard.

Step 1: When you have successfully filled the necessary details for the relevant options in each tab, click the Save and Continue button. This will save all the details that you have provided and may be used in the future.

Note: You will be required to submit a proof of constitution/incorporation of your business in the Business Details and Promoter / Partners tabs.

Step 2: In the case of Authorised Signatory, you may wish to electronically sign (e-sign) the form, for which you will be required to provide the mobile number and/or e-mail address of the authorized signatory.

Step 3: Also, ensure that you have provided necessary details for Primary Place of Business, Goods, and Services, and Bank Accounts tabs.

Registration for Digital Signature Certificate (DSC)

In this step, it is important that you digitally sign the GST Application form for verification. This is mandatory for companies and Limited Liability Partnerships (LLPs).

In order to complete this section, you will need to download and install the Digital Signature Certificate (DSC) on your computer (desktop PC or laptop). The software is available for Windows macOS and Linux operating system platforms. Once you have installed the DSC software on your computer, you will receive a DSC signer.

If you need assistance, you can visit the website http://www.cca.gov.in/ and contact a Certifying Authority.

Verify and Submit the Online GST Application Registration Form

This is the final stage where you will complete your GST Registration online on the government GST portal. There are three ways that lets you verify and submit your GST application registration form. These are:

- Verification of the GST Application form via Digital Signature Certificate (DSC)

- Verification of the GST Application form via e-signature

- Verification of the GST Application form via the Electronic Verification Code (EVC)

When the online GST application process is verified and completed, an Application Reference Number (ARN) will be automatically generated for you and sent to your registered mobile number and e-mail address.

You can also use the ARN number to easily keep track of your GST Application status, which can be accessed from the Registration sub-menu found under the Services menu on your Dashboard.

Conclusion

The guide provided above for registering GST online on the GSTN portal can be of great help to you, especially if you are a first-time user and need help on how to register for GST online. Also, the process stated in the steps above is easy to follow.