How to Become a GST Practitioner?

- December 30, 2019

- Posted by: Editorial Team

- Category:

GST is implemented to bring a unified market in India. Due to the implementation of goods and services tax(GST), millions of business owner has been registered as a taxable person. The GST taxpayer needed various GST compliance to comply. Then the government has introduced various initiatives to make GST compliance easy such as GST practitioners and GST facilitation centers.

Here we will know all about GST practitioners and procedures to become GST practitioners.

GST Practitioner Duties in GST

The work of the GST practitioner in GST on the behalf of the registered person can be listed as follow:

- Furnish the detail of inward and outward supplies.

- Furnish the detail of GST return, annual return, and final returns.

- Makes deposit the credit into the electric cash lender.

- Files a claim for refund.

- Files an application for cancellation or amendment of registration.

Basic Eligibility Criteria to Become a GST Practitioner

The basic eligibility criteria to become a GST practitioner are as follow:

- A person should be an Indian citizen

- A person should be sound mind person

- A person should not be declared as bankrupt

- A person should not be convicted of a crime of imprisonment for more than two years.

Education Qualification to Become a GST Practitioner

The person who can become a GST practitioner are as follow:

- The commercial tax department retired officer from any state government or of the CBEC( Full form central board of excise and customs) having worked in a post of group B (or higher) gazetted officer for the period not less than two years.

- A person should be graduate or postgraduate or it’s equivalent in commerce, law, banking, including higher auditing, or business administration or business management from any Indian university or a recognized foreign university by any law for the time being in force.

- A sales tax practitioner or a tax return preparer registered for a period of more than five years.

- A chartered accountant(CA), Cost Accountant or a Company Secretary

Documents needed for Registration as a GST Practitioner

| Purpose of Document | File Size Format | Maximum Allowable Size | Acceptable Document |

|

Photo of applicant |

JPG |

100 KB |

Any other certificate |

|

Proof of professional address |

JPG/PDF |

120 KB |

Any other certificate or document issued by Government |

|

JPG/PDF |

100 KB |

Any other certificate or document issued by Government |

|

|

JPG/PDF |

100 KB |

Consent lever |

|

|

JPG/PDF |

100 KB |

Electricity bill |

|

|

JPG/PDF |

1 MB |

Legal ownership documents |

|

|

JPG/PDF |

100 KB |

Municipal khata book |

|

|

JPG/PDF |

100 KB |

Property tax receipt |

|

|

JPG/PDF |

2 MB |

Rent/lease agreement |

|

|

JPG/PDF |

1 MB |

Rent receipt with NOC (In case of expired agreement or not available) |

|

|

Proof of qualifying degree |

JPG/PDF |

100 KB |

Degree |

In addition, some documents are also required for enrolment in GST registration as follow:

- Enrolment type (Central or State application),

- Valid e-mail id,

- Valid Phone number,

- Bar Council Membership Proof – For Advocates

- Photograph(JPEG-100kb),

- Office address proof,

- date of enrolment,

- Date of enrolment,

- Membership number and valid up to

- A digital signature, and

- Year of passing

- Name of university/institute and

- Qualification proof: Certificate of Practice – For Chartered Accountant, Company Secretary, Cost, and Management Accountant, Bar Council Membership Proof – For Advocates

Registration Process for GST Practitioner

Here is the step by step guide for registration.

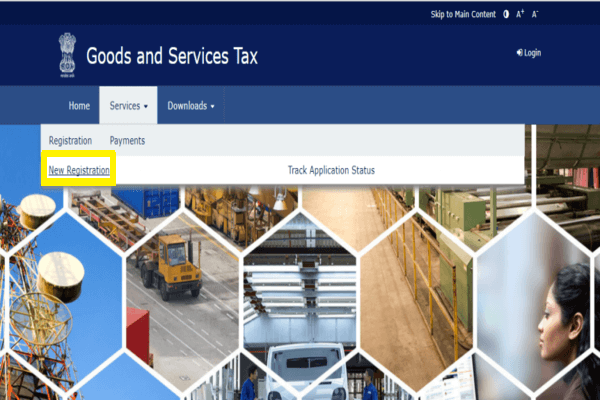

Step 1: To login visit India GST portal or follow this link https://www.gst.gov.in/

Step 2: Afterward, Go to Service>Registration options. Move the cursor and click on the ‘New Registration’ options.

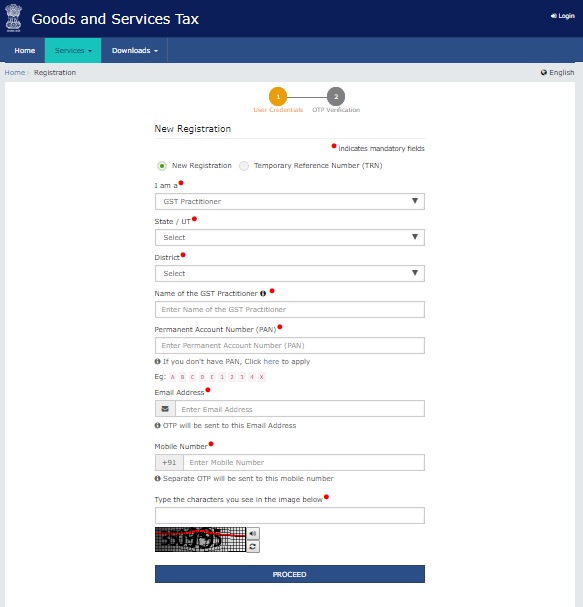

Step 3: In the ‘I am a’ drop-down list choose the ‘GST Practitioner’ options. Afterward, choose the ‘State/UT’ and ‘District’ option from the drop-down list.

Step 4: Fill the Name, PAN, Email address, mobile number, captcha code and enter on the ‘PROCEED’ button.

Once the validation is completed, it will redirect to the OTP verification page.

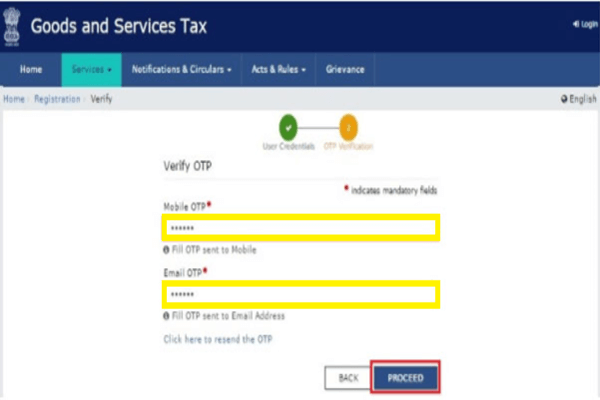

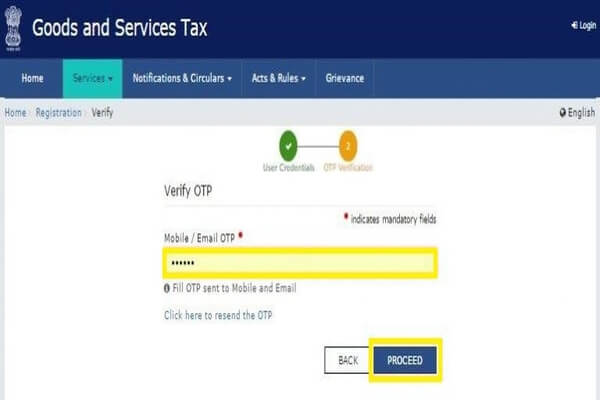

Step 5: Fill the one-time password(OTP) which you received in your mobile number and email address. Click on the ‘PROCEED button.

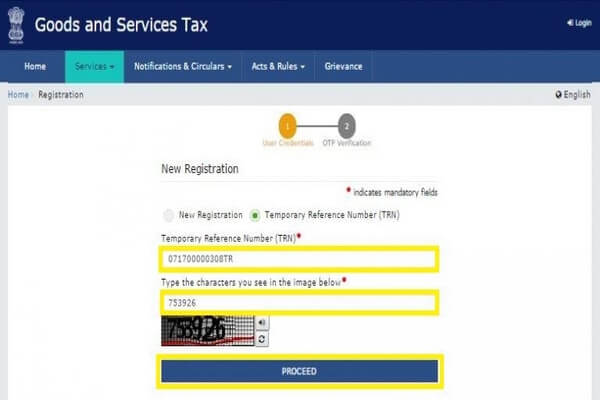

Step 6: Afterward a ‘temporary reference number’(TRN) is generated and then click on the ‘PROCEED’ button.

Step 7: Fill the TRN and Captcha code. Enter on the ‘PROCEED, button.

Step 8: Afterward, fill the OTP which you have received on your mobile number and enter on the ‘PROCEED’ button.

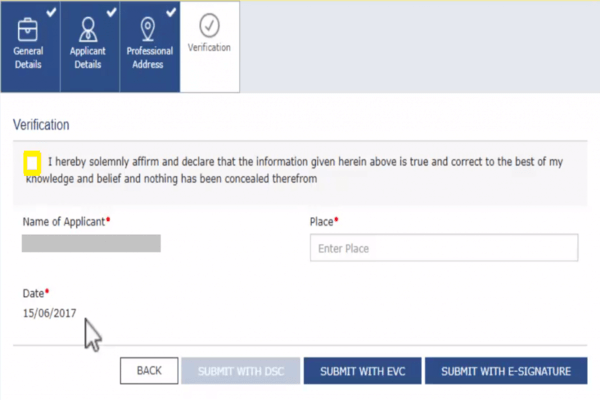

Step 9: Fill all the needed details and upload documents in .pdf and .jpeg format. Enter on ‘Submit’ button on the verification page.

There are two ways by which the application can be submitted.

EVC and E-signature: In this option, you will receive two OTP, one to your mobile number and another to your email address. You will have to fill this OTP correctly and then submit the application.

DSC(Digital signature certificate): In this option, you can submit the application by using the DSC tokens. Marks: Make sure that the DSC is registered on the website as well as emSigner (from eMudra) is installed on your computer.

If the completion is successful, a confirmation message will be pop up on the screen. An acknowledgment will be sent in your registered email within 5 days.

Examination Procedure for GST Practitioner

If the candidates fulfill the basic criteria and education qualification he should enroll himself on the Indian GST portal for GST practitioner in form PCT-01 and received the enroll number from the concerned officer after a due inquiry in form PCT-01.

The exam for enrolment as a GST practitioner is conducted by NACIN (The National Academy of Customs and Indirect taxes and Customs) twice a year across India at selected centers. Some useful points for candidates:

- The center can be selected by the candidate as its choice.

- The exam date is notified by NACIN.

- The exam date is mentioned on the India GST portal as well as the CBIC website.

- The registration can be done by the candidates from the official website of NACIN i.e. nacin.onlineregistrationform.org.

- The examination fees for this exam are rupees 500 which is paid by candidates at the enrolment time.

- It is a computer-based test that consists of multiple-choice questions.

- The result can be declared within 1 month after conducting the exam.

- The candidates must score 50% of the total marks. The candidate is needed to pass this exam within two years from the enrolment and there is no limit to attempt this exam within two years.

Syllabus of Exam

- All-State Goods and Services Tax Rules, 2017

- The Goods and Services Tax (Compensation to States) Act, 2017

- State-specific Goods and Services Tax Acts of 2017

- The Integrated Goods and Services Tax Rules, 2017

- The Central Goods and Services Tax Rules, 2017

- The Central Goods and Services Tax Act, 2017

- The Union Territory Goods and Services Tax Act, 2017

- The Integrated Goods and Services Tax Act, 2017

Exam pattern

- Subject: GST laws and Procedures

- Time allowed: 2 hours and 30 minutes

- Maximum marks: 200

- Number of Multiple Choice Questions: 100

- Qualifying marks: 100

- Negative Marking: No

- Language of Questions: Both English and Hindi

Marks: NACIN issues notifications and circulars before two months of the exam. It also issues the guidelines of the exam.

Benefits of GST Practitioner

There are many benefits to being a GST practitioner. Some of the benefits are as follow:

- He can offer offline services such as the generation of e waybill for the supply of goods.

- He can help if there is any problem with the tax invoice, delivery challan.

- He can help the tax assessment with procedures for GST registration, cancellation, and GST update.

- He is able to see the complete list of taxpayers who are involved in your account.

- He can furnish the details of outward and inward supplies on behalf of registered taxable persons and also can file GST return.

- He is able to make a deposit for credit into the electronic cash ledger.

- He is able to file an application to his claim for return.

- He is also able to file an application for the cancellation of his registration.