How to Calculate GST?

- December 30, 2019

- Posted by: Editorial Team

- Category:

If you are the owner of any business or engaging in the purchase or supply of goods, then you need to pay tax under the GST regime. GST calculator will help you to find out the GST rate of the product as well as differentiate in the category of the GST rate. In this article, we will know how to calculate GST and all about the GST calculator.

GST is a single tax that is imposed on the supply of goods and products. GST’s main aims to bring a unified market for the whole nations. It is a multi-stage, comprehensive, destination-based tax imposed on all value addition. Some products like petrol, alcohol, electricity do not come under the GST tax. These products are taxed under the old tax system. The different forms of GST are as follow:

- SGST(State Goods and services tax): The state government receives this tax

- CGST(Central Goods and services tax): The central government collects this tax

- IGST(Interstate Goods and services tax): The central government receives this tax for imports and interstate trades.

- UTGST(Union Territory Goods and service tax): This tax is received by union territory governments.

What is GST Calculator?

GST calculator is a type of calculator that is used to determine the accurate payable amount of GST on a monthly or quarterly.

How to Calculate GST?

For the taxpayer, It is now possible to know tax rates imposed at different points on several products or services under the GST regime. The taxpayer should know the GST rate that is applicable to various categories. Under the unified system of taxation, the GST rate is applicable 5%, 12%, 18%, and 28%.

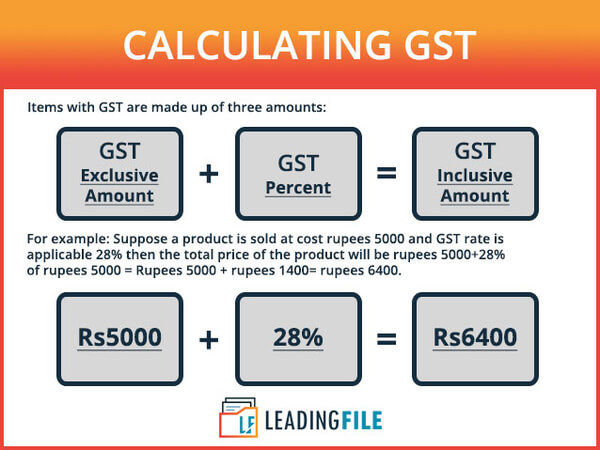

Let understand the GST calculation by using an example:

The formula of GST calculation

The formula for calculating GST is mentioned below:

- Include GST: Amount of GST = (Real Cost x GST%)/100

Net Price = Real Cost + Amount of GST - Exclude GST: GST Amount = Real Cost – [Real Cost x {100/(100+GST%)}] Net Price = Real Cost – Amount of GST

Advantage of GST Calculator

The GST calculator is very useful to find percentage-based GST rates on gross or net goods products. It helps to find the accurate difference rate between CGST, SGST, and IGST. It saves a lot of time and also minimizes the chance of human mistake while calculating the total amount of goods and services.

Conclusion

All the business owner or individual related to purchase or supply of product has to be pay tax under the GST regime. However, the GST calculator plays an important role in determining the accurate GST rate of the net or gross products. It also calculates SGST, CGST, IGST, and UGST rates and provides the difference between them accurately.