HSN Code List For Goods and Service tax & GST Rate Finder

- January 3, 2020

- Posted by: Editorial Team

- Category:

HSN code is the abbreviation for the “Harmonised System of Nomenclature.” This type of system was basically industrialized and introduced by the World Customs Organisation (WCO) in the year 1988. The international HSN code has been implemented in India to systematically classify various goods and services to the rest of the world.

Typically, this code consists of a 6-digit code, which is uniform and classifies more than 5,000 products that are accepted all over the world in the form of exports and imports. Over the years, many revisions have been implemented throughout the globe and the HSN code is currently used by 150 countries.

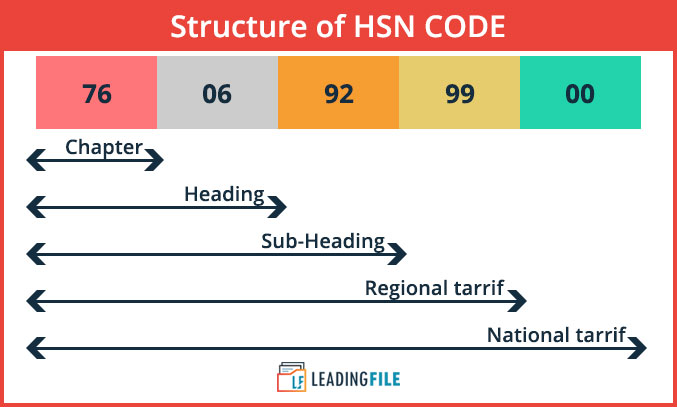

HSN Code and its Structure

The WCO introduced HSN code, having a 6-digit number, which is further comprised of two numbers each for the commodities. The World Customs Organisation (WCO) has issued a criterion, in which the six digits at the beginning of the HSN code cannot be altered. However, it is possible to change only the last four digits and is only changed by the customs authority. The last four digits in the HSN code is generally used for the identification of Regional tariff and National tariff.

Thus, the two numbers each contained in the HSN code are for:

- Chapter (there are 99 chapters under the HSN module)

- Heading (there are 1244 headings under chapters)

- Sub-heading (there are 5224 sub-headings under the heading)

- Regional Tariff

- National Tariff

Importance of International HSN Code

The HSN code provides standardization and global acceptance of the goods. Under the GST regime, it is mandatory for all the commercial enterprises on which the HSN system is relevant to get HSN code with a purpose to levy the proper price of taxes on the set by way of the concerned government of India.

At present, the international HSN code has a 6-digit code that identifies commodities of more than 5,000 groups. This international code is arranged in a logical structure and is bound by legal regulations. Also, this code is well-supported by rules that help achieve a uniform classification of the goods. This is important from facilitating trade internationally.

Over 150 countries use the international HSN code for the following major reasons:

- Uniform classification of goods

- Creating a base for customs tariffs

- International trade statistics collection

Thus, more than 98 percent of the goods/commodities that are traded on a global scale are generally classified in terms of the international HSN code. The HSN code for each goods traded internationally is also accepted by several countries and often remains the same for almost all commodities.

How is HSN Code Applied in India

There are certain criteria on which the HSN system depends on. They are mentioned below:

- This code is not mandated to commercial enterprises that make an annual turnover which is not more than Rs. 1.5 crores. Any company or business whose turnover is more than 1.5 crores Indian rupees but less than 5 crores Indian rupees shall apply 2 digit HSN code.

- Any business or company whose turnover more than Indian rupees 5 crores is needed HSN code.

- Any business or company that is into export and import, without consideration of turnover shall use 8 digit HSN code.

Services Accounting Code (SAC) in GST

Similar to commodities, services too, can be classified uniformly for recognition, measurement, and taxation. Thus, such codes for services are usually termed as Services Accounting Code (SAC).

For example:

Services Accounting Code or SAC is used in various legal documentation and certification services concerning patents, copyrights, and other intellectual property rights. The SAC for such legal documentation can be 998213, where:

(i) The first two digits are the same for all services i.e. 99.

(ii) The next two digits (i.e. 8 and 2) represent the major nature of service, in this case, legal services.

(iii) The last two digits (i.e. 1 and 3) represent the detailed nature of service, such as legal documentation for patents, etc.

HSN Code For GST in India

This code used for items in India after GST implementation is mandatory for all taxpayers. This code is required to identify goods that are supplied in India because earlier, there was not any standard system that could be implemented for identifying commodities. However, now there is a standard system that is implemented with GST in India and can be used to identify commodities for transportation of goods from one place to another with the classification of each merchandise. In India, HSN code and SAC are used for goods and services.

There is also an essential implementation of the HSN code which helps keep track of records, data, and analytics of the goods that are traded internationally to levy fair GST rates in India, correct HSN code or SAC is necessary, especially during return filing. Thus, this will ensure an inlined conformity with the new GST regulations laid down by the government of India.

HSN Code List and GST Rate Finder

The Indian Taxation System has grouped more than 1,211 goods that have GST levied under 6 broad categories, also known as “tax slabs”. The different tax slabs that have been categorized are comprised of 0 percent (or No Tax), 5 percent, 12 percent, 18 percent, and 28 percent, respectively. It is very necessary to know in which category your product or goods has been classified. It is possible to find the category of your product by using the search utility that is provided to help make things easier and quicker.

You can use our GST rate finder tool, which can be used to quickly find the HSN code for the goods or products for invoicing purposes.

By going through the international HSN code list, it will be clear that each commodity traded is assigned with a 6-digit code, which is unique. In India, there are another two digits that are added to this 6-digit HSN code, which is used for further classification of the goods.

The purpose of this code can be well explained through the help of an example. All in all, 21 sections are comprised of 99 chapters divided into 1244 headings and 5224 sub-headings. So, let us take 09024020, which is the code for coffee beans sold in bulk, where 09 is the Chapter, 02 is the heading and 40 is the product code for the coffee beans. The last 2 digits of 20 are code allotted by the Indian taxation system for the coffee beans sold in bags and bulk. Thus, if it were coffee bean bags, then the ending two digits of the HSN code would have been changed with 40 in preference to 20.

Below is a section-wise list of HSN code for groups of goods that are exported to various countries:

| Section | Chapter | HSN Code List |

| Section 1 | Chapters 1 to 5 | Live animals and animal products |

| Section 2 | Chapters 6 to 14 | Vegetable |

| Section 3 | Chapters 15 | Fats and oil of animals or vegetable |

| Section 4 | Chapters 16 to 24 | beverages, vinegar, spirits, and tobacco |

| Section 5 | Chapters 25 to 27 | Minerals products |

| Section 6 | Chapters 28 to 38 | Chemical and para-chemical products |

| Section 7 | Chapters 39 to 40 | Plastic and its articles, rubber and its articles |

| Section 8 | Chapters 41 to 43 | Animal hides and skin |

| Section 9 | Chapters 44 to 46 | wood, cork, manufacture of straw, and its articles |

| Section 10 | Chapters 47 to 49 | Wood, paperboard, paper, and printed products |

| Section 11 | Chapters 50 to 63 | Textiles and its articles |

| Section 12 | Chapters 64 to 67 | footwear, walking sticks, headgear, umbrellas, prepared feathers, artificial flowers, and articles of human hair |

| Section 13 | Chapters 68 to 70 | Stone, minerals, plaster, cement, etc., and ceramic and glass items. |

| Section 14 | Chapters 71 | Precious metals and stones |

| Section 15 | Chapters 72 to 83 | Metals and its articles (Note: Chapter 77 is reserved for future use) |

| Section 16 | Chapters 84 to 85 | Machinery and mechanical appliances, sound recorders and reproducers, electrical equipment, television image and sound recorders and reproducers, and parts and accessories of such articles |

| Section 17 | Chapters 86 to 89 | Vehicles, vessels, aircraft, and associated transport equipment |

| Section 18 | Chapters 90 to 92 | Cinematographic, photographic, and musical apparatus and accessories measuring surgical, medical, and other instruments and clocks and watches |

| Section 19 | Chapters 93 | Arms and ammunition |

| Section 20 | Chapters 94 to 96 | miscellaneous manufactured articles |

| Section 21 | Chapters 97 to 99 | collector’s pieces, work of arts, and antiques (Note: Chapter 99 is reserved for national use) |

Note: Central Board of Indirect Taxes and Customs Goods and Services Tax.

Visit this website for more information: https://www.cbic-gst.gov.in/gst-goods-services-rates.html