www.gst.gov.in Government GST Portal Login Online

- January 6, 2020

- Posted by: Editorial Team

- Category:

The GST portal www.gst.gov.in, which is an initiative of the Government of India, was launched for the purpose of carrying out operations relating to Goods and Services Tax (GST) by individuals and business owners as well. The regulation became effective since 2017 and currently imposes tax on major goods/commodities and services within the country and overseas, too.

In this article, we will provide an insight on the official GST portal www.gst.gov.in of the government of India and know all about the government GST portal login, including other services that are available on the website.

Government GST Portal – A Detailed Overview of Its Homepage

The official government GST portal provides essential services to hundreds and thousands of taxpayers, which includes individual persons, owners of small, medium and large-sized businesses and independent service providers. The website is a one-stop place for payment of taxes, traversing through GST Return filing, generating electronic bills, utility for refunds, filing returns, GST registration, applying for cancellation of GST registration and much more. It can be easily accessed from a computer and/or a handheld electronic device, such as smartphones and tablets, although this requires a web browser and an Internet connection via Wi-Fi, mobile data or a Hotspot connection.

The importance of the GST regime is to make the best use of modern technology for administering this type of indirect taxation system in the country. Thus, this initiative by the government of India makes it efficient for taxpayers to carry out the necessary tasks online, such as assessments and submitting applications or returns without the need for visiting the Income Tax department. The GST portal permits all such communications to be easily achieved in conjunction with responding to programs, accepting or rejecting applications or intimating notices by way of the branch and conveying the same to the taxpayers.

In the following sections, we are going to take a quick look at the features that are provided on the government GST portal www.gst.gov.in and you, as a taxpayer will require.

Services Available on the GST Portal’s Homepage Menu

When you visit the government GST portal www.gst.gov.in, which is an official website recognized by the government of India, you will be welcomed to the homepage that offers plenty of important services.

The category of useful items or services, along with their respective sub-items or services which are displayed in the main menu (top menu) on the website’s homepage include:

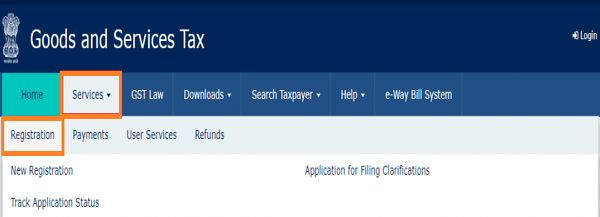

Services

The Services menu can be used by individuals and business owners to register themselves under the GST, who generally make a turnover of over Rs. 40,00,000.00 in a year. A turnover of over Rs. 10,00,000.00 is applicable for persons in the north-eastern region and hill states only. In addition to this, there are other services as well which can be availed from the Services menu in the GST portal. This includes:

Registration

- New Registration

- Track Application Status

- Application for Filing Clarifications

Payments

- Create Challan

- Grievance against Payment (GST PMT-07)

- Track Payment Status

User Services

- Holiday List

- Locate GST Practioner (GSTP)

- Generate User ID for Unregistered Applicant

- Cause List

Refunds

- Track Application Status

GST Law

The services here consist of the CGST Act and rules that are in relation to the GST. It contains the following sub-services:

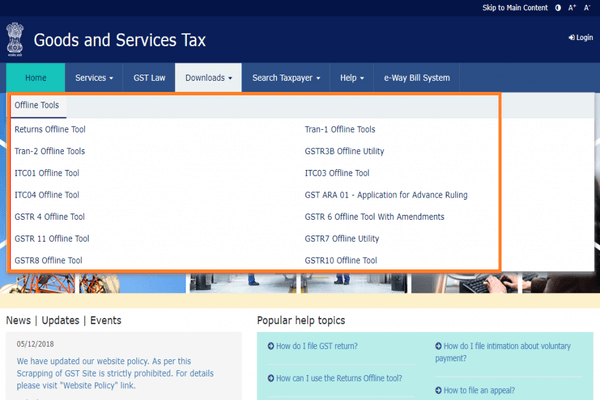

Downloads

Offline Tools

- New Return Offline Tool (Beta)

- Tran-1 Offline Tools

- GSTR3B Offline Utility

- ITC03 Offline Tool

- GST ARA 01 – Application for Advance Ruling

- GSTR 6 Offline Tool With Amendments

- GSTR7 Offline Utility

- GSTR10 Offline Tool

- GSTR 9A Offline Tool

- Returns Offline Tool

- Tran-2 Offline Tools

- ITC01 offline Tool

- ITC02 Offline Tool

- GSTR 4 Offline Tool

- GSTR 11 Offline Tool

- GSTR8 Offline Tool

- GSTR-9 Offline Tool

- GSTR-9C Offline Tool

Proposed Return Documents

- New GST Return – Normal

- New GST Return – Sugam

- New GST Return – Sahaj

GST Statistics

Search Taxpayer

- Search by GSTIN/UIN

- Search by PAN

- Search Composition Taxpayer

Help

- System Requirements

- User Manuals, Videos, and FAQs

- GST Media

- Site Map

- Grievance Redressal Portal

e-Way Bill System

New Return (Trial)

- New Return Prototype

- Offline Tools for New Return (Trial)

These are the various services that are available to taxpayers on the GST portal of the government of India.

GST Portal System Requirements

In order to access the government GST portal and all of its features properly, there are certain hardware and software requirements that must be met by users for an optimal experience.

(i) System Requirements for Accessing the GST Common Portal

Given below are the system requirements in general which must be met in order to access the GST portal on your desktop PC or laptop:

- Web browser: Firefox (version 45 or newer), Chrome (49 or newer) or Internet Explorer (version 10 or newer). Other web browsers supported are Edge, Safari, Opera.

In addition to the web browsers mentioned above, the following programs and/or services must be enabled/allowed in your web browser:

- Cookies: Cookies are usually required to store certain personal information of the user temporarily. As such, disabling cookies on your web browser will not allow you to log in to the website as well as carry out any transactions.

- JavaScript: JavaScript is a program that is used to provide enhanced user experience, such as rendering user controls and buttons on the website.

- Cascading Style Sheets (CSS): The purpose of the Cascading Style Sheet (CSS) element in web browsers is to allow displaying the look and feel of the user interface of websites.

(ii) System Requirements for Usage of Digital Signature Certificate (DSC)

In case your web browser requires additional certificates for the proper functioning of the GST portal, you can simply use a file compression tool like WinRAR, WinZip or 7-Zip to extract the necessary certificates for your browser.

Usually, your web browser will automatically attempt to obtain valid class 2 or class 3 digital signature certificates from the DSC provider. The GST portal, however, only supports Crypto Tokens in Hard Tokens for DSC Registration. Users are further advised to refer to the Hard Tokens based certificates manual that is provided by the Certifying Authority in order to download the certificate, enroll and use Hard Token.

Note: Currently, mobile devices and browsers do not allow or support signing using digital signature certificates (DSC).

(iii) System Requirements for Downloading and Installing the Web Socket Installer

In simple terms, Web Sockets is a technology protocol that allows a client web browser to communicate interactively with the server in real-time. However, there are certain pre-requisites for installing Web Sockets, which are listed as under:

- Operating System: Windows 7 or later operating system (32-bit and 64-bit), macOS 10.11 El Capitan or later, Linux.

- Java 1.8 or newer and Java Runtime Environment (JRE)

- Users must have administrator privileges to install the Document Signer installer (emSigner component) for Web Sockets.

- Allow one of the ports in Windows Firewall – 1585, 2095, 2568, 2868 or 4587.

Once you have met all the necessary pre-requisites, you can download the Document Signer installer that is available from the DSC Registration page of the government GST portal. You may follow the steps given on this guide to download and install the emSigner component for Web Sockets on your Windows operating system.

Steps:

1. On your web browser, go to the link https://gst.gov.in/help/docsigner. You will be redirected to the DSC Registration page, where you can download the Document Signer installer for your operating system.

2. Select your operating system and click the link shown under Download. The emSigner.msi file will start downloading automatically, or you may be prompted to manually download and save the installer on your local drive.

3. When the download is complete, launch the emSigner.msi installer from the Downloads folder on your computer. The emSigner Setup Wizard will be displayed on your screen that will guide you through the rest of the installation process.

Note: This step is similar to both Windows and macOS platforms.

However, in the Linux platform, the setup wizard will not appear – an in-built software/package manager will install it for you when you double-click the file. If you are a Linux user, you do not have to follow the next steps as the installation is complete here.

As for Windows and macOS users, continue the steps given below:

1. On the emSigner Setup Wizard window, click the Next button to proceed with the installation.

2. In the Select Installation Folder window, a default location will already be selected where the emSigner component will be installed on your computer. You may provide a different location, if you are an advanced user, else keep the default selection. Click the Next button.

3. Finally, the Ready to Install window will appear on your screen that will await your confirmation in order to proceed with the installation. Click the Install button and wait for the installation process to complete. This takes only a few seconds.

4. After the installation is complete, click the Finish button to close the emSigner Setup Wizard window.

5. A shortcut icon for the emSigner service will be automatically placed on your desktop screen. Simply right-click the desktop icon and select Run as Administrator to launch the program with administrative privileges.

6. A message box will appear on your screen confirming that the emSigner service has been successfully started. Click the OK button to close the message box.

7. The Digital Signature Signer window will now appear on your screen with the emSigner service started. You may also choose to stop the service, if not required manually.

Login to GST Portal of Government of India

After being done with the necessary installation of pre-required service components, you should be able to register online and log in to the GST portal and avail the services that are provided by the website. When you log in to the GST portal, you are taken to the Dashboard, which is your user account page that allows you to access services and manage your user profile. From the Dashboard, you can easily file your tax returns, generate bills, create tax payment challan and so on.

Note: It is required that taxpayers must register on the GST portal in order to use the services online. Once you are successfully registered and created a user ID and password (your login credentials), you will need this each time you log in to the website.

We have already covered the topic of “How to register on the GST portal” [GST Registration].

Conclusion

As of September 20, 2019, new reforms have been introduced in the GST regulations at the 37th Council meeting. A few of these are stated as under:

GSTR-9A filing for composition taxpayers has been waived off for the fiscal year (FY) 2018-19.

GSTR-9 filing for businesses making a turnover of Rs. 2 crores are rendered optional for the fiscal year 2018-19.

A committee will be constituted to analyze the simplification of the Annual Return forms and reconciliation statement.