How to Pay GST Online – GST Payment Process, Rules & Form

- December 31, 2019

- Posted by: Editorial Team

- Category:

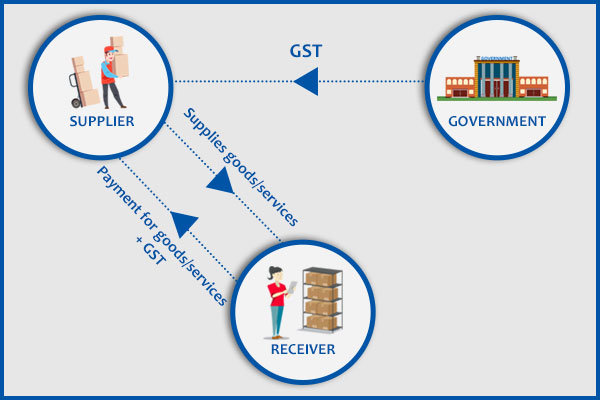

GST is a new revolution in the field of tax. It is beneficial for both the public as well as the government. All businesses owner or professional self-employed connected with the buy or supply of products or services is need to pay GST tax. Many taxpayers want to know GST online payment method and how to pay GST online. So here we will know all about the GST payment process.

What is GST Payment?

To calculate the GST payment, first of all, reduce input tax credit(ITC) and then subtract it from the outward tax liability. Afterward, add late fee or interest if any and subtract the TCS/TDS charge. The calculating amount is the exact amount for the GST payment.

When Do You Need to Pay GST?

If you are registered for GST and are not part of the composition scheme, you will have to file your tax by the 10th of every month. The previous month covers these returns. Any GST given by you is owed on the 20th of every month.

In case you are participating in a composition scheme, then there is a different payment schedule. In this case, you will have to file quarterly returns and pay GST by the 18th of the month. Keep in mind that GST Council sometimes adjusts these dates if there are technical issues or other problems, so it is a good idea to check the GST portal for updates.

There are certain situations where the recipient of goods, such as imports and other notified supplies, is required to make GST payments online. Such types of supplies are also commonly known as reverse charge supplies. In addition, there are also situations where the liability to be pay tax is on the third-person. The common examples of such supplies are TDS and TCS, respectively.

According to the regulations laid under the newly revised GST Act, 2017, the taxpayer is required to pay GST on goods or services at the time of the supply. The supply time as per the GST Act is generally the earliest of the following:

- Issuance of invoice

- Receiving payment

- Completion of suppl

Features of GST Payment Online Process

There are a couple of vital features of the GST payment online process under the GST taxation system. These features include the following:

- It is a hassle-free facility for GST payment online

- All transactions and payments are carried out paperless

- It initiates quick accounting and reporting

- A taxpayer is required to generate challan electronically through the Goods and Services Tax Network (GSTN) portal, irrespective of the method of payment selected.

- A taxpayer is rendered the facility to make his/her tax payments via different methods or modes.

- The electronic GST system collects the tax data and is maintained in an electronic/digital format.

- It allows swift remittance of taxation revenue within the accounts of the government.

- It electronically reconciles all receipts

- It also simplifies processes for banks

- It stores all electronic/digital challans in a database

Step by Step Process by which You can Make GST Payment Easily

Here is the step by step guide to make GST payment easily:

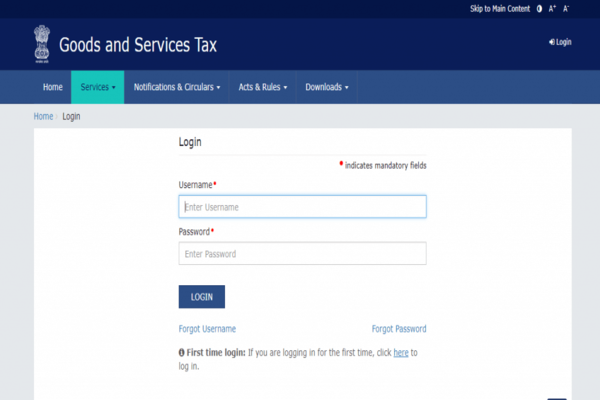

Step 1: To pay GST online, first of all, you need to login to the GST portal. For login, you need to fill your username and password.

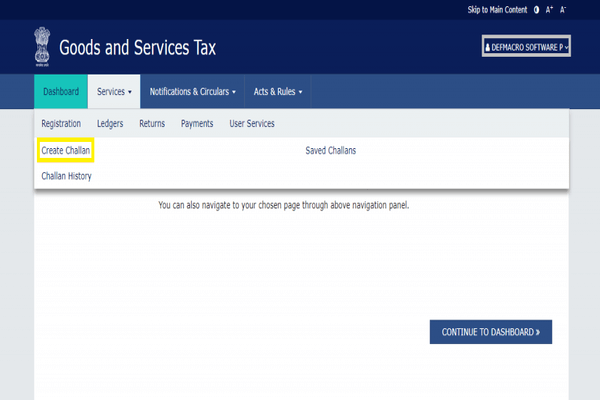

Step 2: After login, you need to go services>payments>Create challans, options

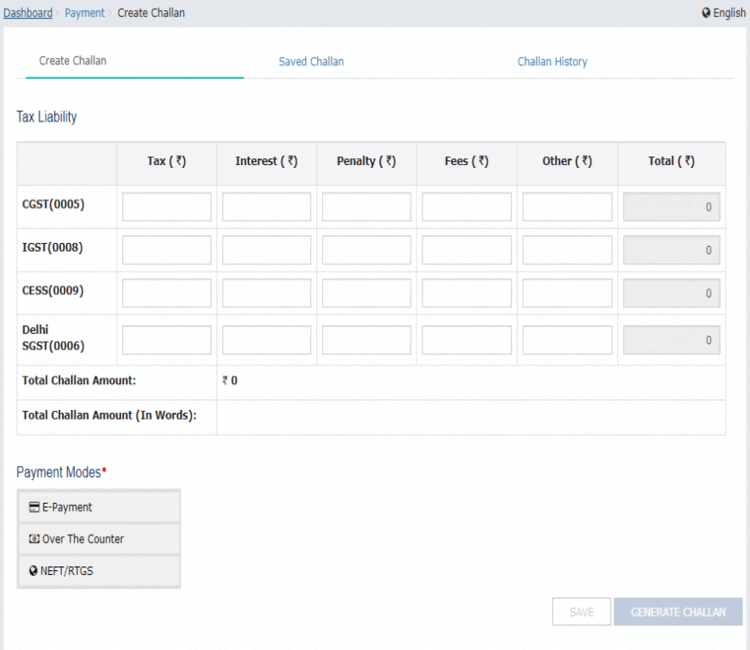

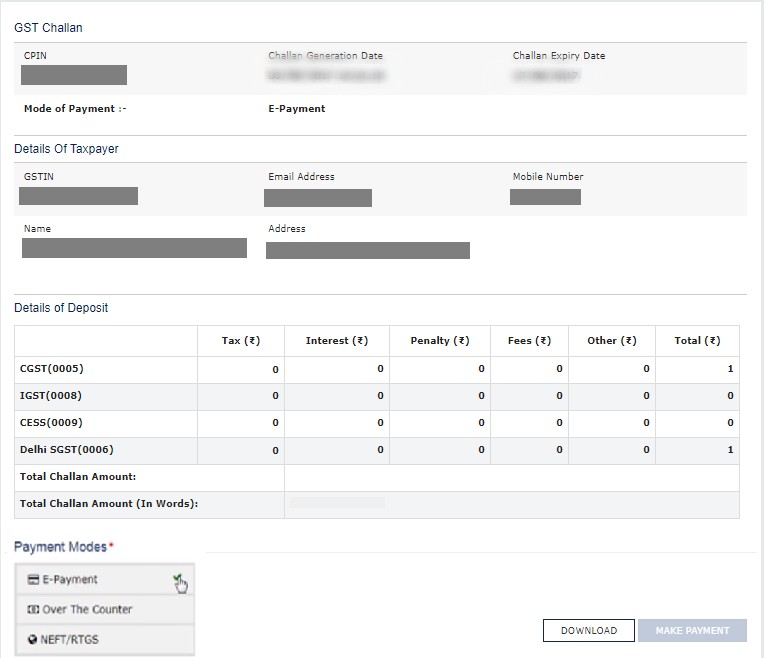

Step 3: After filling the selected amount and payment method, click on the Generate Challan option. Here you will get three payment methods to make the payment i.e. E-payment, NEFT/RTGS, and over the counter.

If you want to pay through the ‘over the counter” method, then there is a limitation of rupees 10000 per challan.

Step 4: A new page will open which contains all the detail of challan. Here you have to select the payment method. If you want to pay offline then selects ‘over the counter’ method. If you want to pay online then select E-payment and NEFT/RTGS options. Click on “Payment Modes”.

Step 5: By using the option of NEFT/RTGS you can make GST payment online or you can make GST payment through the bank after taking a printout of challans.

Once the payment has made you will receive a challan which contains all the details of paid tax. Afterward, the tax paid Challan (CIN) will be submitted to the cash ledger account of the taxpayer.

Pay GST with Credit Ledger

If you are ready to pay GST, then you can start from a credit ledger. The benefit of paying GST with credit ledger is that your input tax credit(ITC) increases over time. Another benefit is that this credit can decrease your tax every month. You can use this credit to pay only taxes. You cannot use this credit to pay penalties, interest or other kind fees. In the form GST PMT-02, you can obtain your ledger.

When you get input tax credit(ITC), it gets divided into categories for IGST, SGST, and CGST. There is a governmental rule to uses these credits.

- IGST credit is firstly used to pay IGST tax. If additional credit remains, then it will be applied for CGST and then for SGST.

- CGST credit is firstly used to pay CGST tax. If additional credit remains, then it will be used to pay IGST.

- SGST credit is firstly used to pay SGST tax. If extra credit remains, then it will be used to pay IGST.

Pay GST with Cash Lender

once, you use credit to pay GST tax; you can use cash lender to pay remains tax if any. The cash lender is just like a digital wallet. If you put money in, the government will cut it to pay your GST bill. Form GST PMT-05 is your lender on the GST portal.

Whenever you need to pay a monthly tax bill, firstly you have to create a challan in the GST portal. Once you create the challan you can pay the GST bill by using internet banking, a credit card, a debit card, an NEFT/RTGS from any bank. From ‘over the counter’ payment method, you can pay not more than 10000 rupees.

Once you make payment, it will automatically be credited to your cash lender. There is a maximum of 15 days to make deposits after creating a challan.

Mostly every business pay taxes online. By tracking your credit balances and making deposits on time, you can decrease your penalties, interest or other kinds of fees.

Note: There are three ledgers on the GST portal to pay taxes and manages GST payment i.e input tax credit(ITC) ledger, cash ledger, tax liability ledger.

GST Payment Forms

For dealers responsible for paying online GST in India, the below GST payment forms are needed-

| Form GST PMT-01 | Maintains electronic tax liability register |

| Form GST PMT-02 | Manages the electronic credit ledger |

| Form GST PMT-03 | The electronic credit ledger issued by an authorized officer includes an order to reject the claim for refund of the balance. |

| Form GST PMT-04 | This form is Used to conduct any discrepancies in your electronic loan book. |

| Form GST PMT-05 | Maintains the electronic cash ledger |

| Form GST PMT-06 | Invoice for payment of tax, interest, penalty, fee or any other amount is included. |

| Form GST PMT-07 | To indicate that your bank account has been debited but not CIN generated or CIN generated but not reflected on GST portal |

Conclusion

The GST payment process and GST payment schedule are important for any business so as to remain compliant. Thus it is essential that every business is aware of the required GST payment formats, calculate the correct GST payment, follow the GST payment dates and accordingly pass the GST payment voucher in their books, so that GST payment can be made online.

When you generate a challan, you will notice on it a CIN, which stands for Challan Identification Number. This CIN consist of 17 digits, where the 14 digits at the beginning denotes the CPIN and the remaining 3 digits denote the bank code. The CIN is generated by the authorized bank or the Reserve Bank of India (RBI) at the time when the amount is credited into the relevant account of government. Also, the CIN generated is communicated to both the Goods and Services Tax Network (GSTN) and the taxpayer.

The challan that is generated is usually valid for a period of 15 days (from the date of generation). So, the taxpayer will need to generate a new challan in case of the expiration of the previously generated challan.