SAC Code List, Full Form, Meaning and GST Rates On Services

- January 7, 2020

- Posted by: Editorial Team

- Category:

As you may probably know by now that the government of India passed a new GST regulation under the GST Act, in which the rates on taxes for various goods and services have been revised and implemented in the country as a whole. Every service rendered is classified by a unique SAC code that can be used in invoices or bills by service providers for rendering their services to individuals and/or businesses.

In this article, we are going to look at what Services Accounting Code (SAC) is, the inclusion of services in the SAC list and also know about the revised GST rates that have been levied on various services under the GST regulations issued by the government of India.

SAC Code Full Form and Meaning

The full form of SAC code ~ Service Accounting Code.

Where in each and every letter has its own word and meaning? Have a look…

- S stands for ~ “Service.”

- A stands for ~ “Accounting.”

- C stands for ~ “Code.”

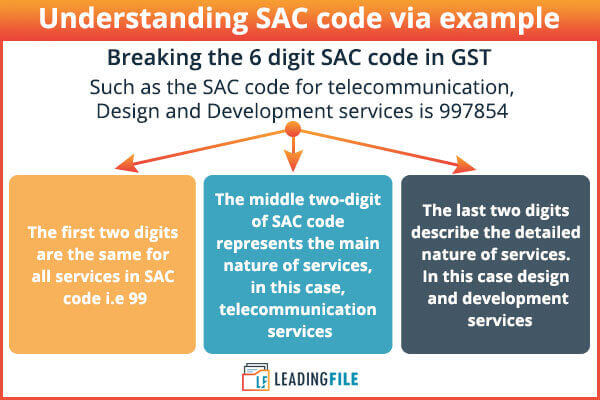

All three words Service, Accounting, and Code have different meanings in terms of GST. Let’s understand sac code through an example:

A Brief Overview of Services Accounting Code (SAC)

Services Accounting Code (SAC) helps to sort out a wide array of services under the goods and services tax (GST) law. All transactions with regards to GST taxes levied on various goods and services in India are basically categorized in the Services Accounting Code (SAC). Furthermore, goods are segregated from services, where all goods, which includes all types of taxable products and commodities fall in the HSN Code system category, whereas all taxable services that are rendered in the country are grouped under what is called the Services Accounting Code (SAC) system.

The Service Tax Department of India is behind the planning and maintenance of the SAC system of code.

SAC Code List Download

SAC Code List and GST Rates on Services

Here, we are going to take a look at the SAC code list for various services that are taxed under the GST regulations issued by the GST Act, under the authority of the government of India. Generally, all taxable services in India are classified under the Services Accounting Code (SAC). Thus, this SAC code format is comprised of a 6-digit numeric only code. Every single service is recognized with the help of this unique SAC code system. This is also helpful, especially for individuals and businesses to be able to easily provide in the invoices when rendering services to their clients and/or customers.

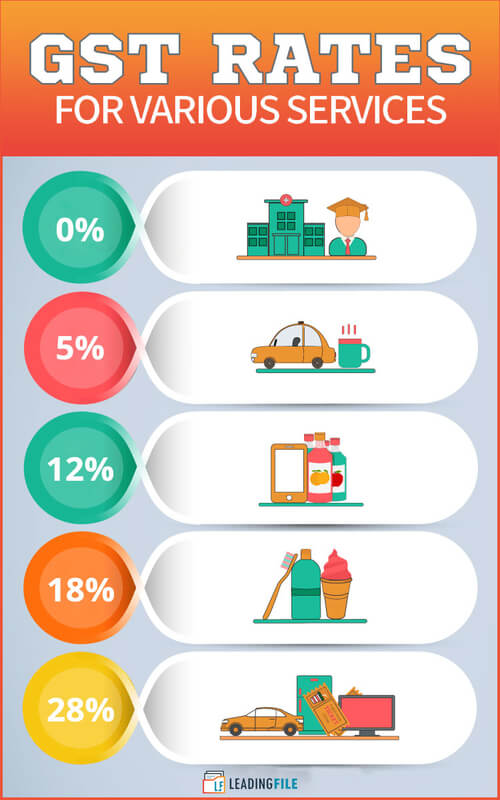

Services that are rendered to both individuals and businesses that are taxed under the GST regulations are basically classified in five GST rate slabs. These five GST rate slabs that are imposed on services fall in the slabs of 0 percent, 5 percent, 12 percent, 18 percent, and 28 percent, respectively. These will be explained in detail in the later sections on this article, as we go ahead learning more about the SAC code list and GST rates on services.

It should be noted here that services that are not subject to taxation, or services in which the GST rates are not cited, then in such a case, the default GST rate of 18 percent shall be levied on such services in India.

Given below are the various SAC codes, along with their respective GST rates for the services that are included in the GST regulations.

SAC Code for Job Work

The SAC code for “Job Work” is 9988, where the last two digits ‘88’ represents the major nature of service, which in this case is “Job Work.” This nature of services is categorized as given below along with their SAC code.

1. Job Work Related to Textile, Apparel And Leather Products (SAC code 998821 to SAC code 998823)

- Newspaper printing

- Textile yarns (other than human-made fibers) and textile fabrics

- Cut and polished diamonds, precious and semi-precious stones, plain and studded jewelry of gold or and other precious metals that are included in Chapter of HSN

- Printing of books (includes Braille books), journals and periodicals

- Processing of leather, skins, and hides

2. Job Work Related to Food, Beverage and Tobacco Manufacturing (SAC code 998811 to SAC code 998819)

- SAC Code 998811 – Meat processing services

- SAC Code 998812 – Fish processing services

- SAC Code 998813 – Fruits and vegetable processing services

- SAC Code 998814 – Vegetable and animal oil and fat manufacturing services

- SAC Code 998815 – Dairy product manufacturing services

- SAC Code 998816 – Other food product manufacturing services

- SAC Code 998817 – Prepared animal feeds manufacturing services

- SAC Code 998818 – Beverage manufacturing services

- SAC Code 998819 – Tobacco manufacturing services

3. Job Work Related to Wood and Paper Manufacturing

- SAC Code 998831 – Wood and wood product manufacturing services

- SAC Code 998832 – Paper and paper product manufacturing services

4. Job Work Related to Petroleum, Chemical and Pharmaceutical Product Manufacturing (SAC code 998841 to SAC code 998843)

- SAC Code 998841 – Coke and refined petroleum products production services

- SAC Code 998842 – Chemical product manufacturing services

- SAC Code 998843 – Pharmaceutical product manufacturing services

5. Job Work Related to Rubber, Plastic and Non-Metallic Mineral Product Manufacturing (SAC code 998851 to SAC code 998853)

- SAC Code 998851 – plastic and rubber product manufacturing services

- SAC Code 998852 – Plastic product manufacturing services

- SAC Code 998853 – Other non-metallic mineral product manufacturing services

6. Job Work for Basic Metal Manufacturing Services

- SAC Code 998860 – Basic metal manufacturing services

7. Job Work Related to Fabricated Metal Product, Machinery and Equipment Manufacturing (SAC code 998871 to SAC code 998877)

- SAC Code 998871 – Reservoir, structural metal product, tank, and steam generator manufacturing services

- SAC Code 998872 – Weapon and ammunition manufacturing services

- SAC Code 998873 – Metal treatment services and other fabricated metal manufacturing products.

- SAC Code 998874 – Electronic, Computer, and optical product manufacturing services

- SAC Code 998875 – Electrical devices manufacturing services

- SAC Code 998876 – Common purpose machinery production services

- SAC Code 998877 – Special purpose machinery manufacturing services

8. Job Work for Transport Equipment Manufacturing

- SAC Code 998881 – Traile and motor vehicle manufacturing services

- SAC Code 998882 – Other transport equipment manufacturing services

9. Job Work Related to Other Products Manufacturing (SAC code 998891 to SAC code 998898)

- SAC Code 998891 – Furniture manufacturing services

- SAC Code 998892 – Jewellery production services

- SAC Code 998893 – Imitation jewelry manufacturing services

- SAC Code 998894 – Musical instrument manufacturing services

- SAC Code 998895 – Sports goods manufacturing services

- SAC Code 998896 – Toy and game manufacturing services

- SAC Code 998897 – Dental and medical instrument and supply manufacturing services

- SAC Code 998898 – Other manufacturing services

SAC Codes and GST Rates for Goods Transport Services

1. Services for Transportation of Goods by Land:

- SAC Code 996511 – Goods, such as letters, parcels, live animals, household and office furniture, containers, etc. that are transported via road transport services (refrigerators vehicles, trucks, trailers, man or animal-drawn vehicles or any other vehicles).

- GST Rate: 0%

- SAC Code 996512 – Goods, such as letters, parcels, live animals, household and office furniture, intermodal containers, bulk cargo, etc. that are transported via railway transport services.

- GST Rate: 0%

- SAC Code 996513 – Transport services of petroleum and natural gas, water, sewerage, and other goods via pipeline.

- GST Rate: 18%

- SAC Code 996519 – Other land transport services for goods.

- GST Rate: 18%

2. Services for Transportation of Goods by Water/Sea:

- SAC Code 996521 – Coastal and overseas water transport services of goods via refrigerator vessels, tankers, bulk cargo vessels, container ships, etc.

- GST Rate: 18%

- SAC Code 996522 – Inland water transport services of goods by refrigerator vessels, tankers, and other vessels.

- GST Rate: 0%

3. Services for Transport of Goods by Air and Space

- SAC Code 996531 – Goods such as letters and parcels and other goods that are transported by air transport services.

- GST Rate: 18%

- SAC Code 996532 – Freight transported by space transport services.

- GST Rate: 18%

4. Rental Services of Transport Vehicles (with or without operators)

- SAC Code 996601 – Rental services of road transportation, which includes buses, coaches, cars, trucks and other motor vehicles (with or without operator).

- GST Rate: 18%

- SAC Code 996602 – Rental services of water transportation, which includes passenger ship/boat, freight vessels, etc. (with or without operator).

- GST Rate: 18%

- SAC Code 996603 – Rental services of air transportation, which includes passenger aircraft, freight aircraft, etc. (with or without operator).

- GST Rate: 18%

- SAC Code 996604 – Rental services of other transport vehicles (with or without operator).

- GST Rate: 18%

5. Supporting Services in Transport

- SAC Code 996711 – Services for handling cargo

- GST Rate: 18%

- SAC Code 996712 – Services for handling container

- GST Rate: 18%

- SAC Code 996713 – Customs House Agent service

- GST Rate: 18%

- SAC Code 996719 – Clearing and forwarding service

- GST Rate: 18%

6. Storage and Warehousing Services

- SAC Code 996721 – Refrigerated storage services

- GST Rate: 18%

- SAC Code 996722 – Bulk liquid or gas storage services

- GST Rate: 18%

- SAC Code 996729 – Other storage and warehousing services

- GST Rate: 18%

7. Support Services for Railway Transportation

- SAC Code 996731 – Railway pushing or towing services

- GST Rate: 18%

- SAC Code 996739 – Other supporting services for railway transport

- GST Rate: 18%

8. Support Services for Road Transportation

- SAC Code 996741 – Bus station services

- GST Rate: 18%

- SAC Code 996742 – Operation services for tunnel operation, bridges, streets, roads, expressways, and national highways

- GST Rate: 18%

- SAC Code 996743 – Services for parking lots

- GST Rate: 18%

- SAC Code 996744 – Services for towing private and commercial vehicles

- GST Rate: 18%

- SAC Code 996749 – Other support services for road transportation

- GST Rate: 18%

9. Support Services for Water Transportation (Inland Waterways, Coastal, Overseas)

- SAC Code 996751 – Port and waterway operation services (excludes cargo handling) such as operation services of ports, docks, lightships, lighthouses, etc.

- GST Rate: 18%

- SAC Code 996752 – Pilotage and berthing services

- GST Rate: 18%

- SAC Code 996753 – Vessel salvage and refloating services

- GST Rate: 18%

- SAC Code 996759 – Other support services for water transportation

- GST Rate: 18%

10. Support Services for Air or Space Transportation

- SAC Code 996761 – Support services for airport operation (excludes cargo handling)

- GST Rate: 18%

- SAC Code 996762 – Support services for air traffic control

- GST Rate: 18%

- SAC Code 996763 – Other support services for air transportation

- GST Rate: 18%

- SAC Code 996764 – Support services for space transportation

- GST Rate: 18%

11. Miscellaneous Transport Support Services

- SAC Code 996791 – Goods transport agency services for road transport

- GST Rate: 5%

- SAC Code 996792 – Air traffic control services

- GST Rate: 5%

- SAC Code 996793 – Other goods transport services

- GST Rate: 5%

- SAC Code 996799 – Other support transport services

- GST Rate: 18%

Transportation Services Excluded Under Goods and Services Tax (GST)

Here are some of the other transportation services which are exempted under the Goods and Services Tax (GST).

Road Transportation Services:

- Goods transportation agency

- Courier agency

Inland Waterways

Conclusion

The Services Accounting Code (SAC) codes for various goods and services in India are primarily used by the service taxation department to classify, recognize, and measure services that are rendered to other businesses and individuals. This unified code is provided to better distinguish among the wide array of services along with each service’s respective GST rate that is charged as tax.